Cigna 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

66

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

As of December 31, 2010, the Company’s investments in other

asset and mortgage-backed securities totaling $754 million included

$477 million of investment grade private placement securities

guaranteed by monoline bond insurers. Quality ratings without

considering the guarantees for these other asset-backed securities

were not available.

As of December 31, 2010, the Company had no direct investments

in monoline bond insurers. Guarantees provided by various

monoline bond insurers for certain of the Company’s investments

in state and local governments and other asset-backed securities as of

December 31, 2010 were:

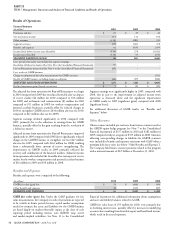

Guarantor

(In millions)

As of December31,2010

Indirect Exposure

National Public Finance Guarantee (formerly MBIA, Inc.) $ 1,217

Assured Guaranty Municipal Corp (formerly Financial Security Assurance) 589

AMBAC 176

Financial Guaranty Insurance Co. 37

TOTAL $ 2,019

AMBAC fi led for bankruptcy during the fourth quarter of 2010.

However, the Company does not expect this action to materially

impact valuations of guaranteed securities given the high quality of

underlying issuer credit without this guaranteed support.

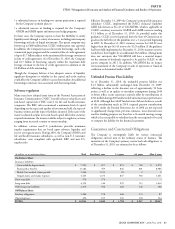

Commercial Mortgage Loans

e Company’s commercial mortgage loans are fi xed rate loans,

diversifi ed by property type, location and borrower to reduce exposure

to potential losses. Loans are secured by high quality commercial

property and are generally made at less than 75% of the property’s

value at origination of the loan. In addition to property value, debt

service coverage, which is the ratio of the estimated cash fl ows from

the property to the required loan payments (principal and interest),

is an important underwriting consideration. e Company holds no

direct residential mortgage loans and does not securitize or service

mortgage loans.

e Company completed its annual in depth review of its commercial

mortgage loan portfolio in July, 2010. is review included an analysis

of each property’s most recent annual fi nancial statements, rent rolls

and operating plans and budgets for 2010, a physical inspection of

the property and other pertinent factors. Based on property values

and cash fl ows estimated as part of this review, along with updates

for portfolio activity subsequent to the review, the portfolio’s average

loan-to-value ratio improved to 74% as of December 31, 2010 from

77% as of December 31, 2009. e portfolio’s debt service coverage

was estimated to be 1.38 as of December 31, 2010, down from 1.48

as of December 31, 2009.

Values estimated for the properties in CIGNA’s mortgage portfolio

refl ect improving commercial real estate capital markets, with

stabilizing, and in some instances, increasing values, for well leased,

quality commercial real estate located in strong institutional markets,

the quality refl ected by the vast majority of properties securing the

mortgages. e deterioration in property cash fl ows (and resulting

debt service coverage levels) estimated as part of the review refl ects

generally weak fundamentals (higher vacancy and reduced rental

rates) across property types and markets. While commercial real

estate capital markets improved during 2010 and there are some

signs of improvement in fundamentals, a sustained recovery will

be dependent on continued improvement in local markets and the

broader national economy.

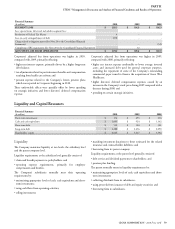

e following table refl ects the commercial mortgage loan portfolio

as of December 31, 2010 summarized by loan-to-value ratio based on

the annual loan review completed in July, 2010.

LOANTOVALUE DISTRIBUTION

Loan-to-Value Ratios

Amortized Cost

% of Mortgage LoansSenior Subordinated Total

Below 50% $ 195 $ 157 $ 352 10%

50% to 59% 486 33 519 15%

60% to 69% 600 64 664 19%

70% to 79% 310 30 340 10%

80% to 89% 805 33 838 24%

90% to 99% 544 27 571 16%

100% or above 202 - 202 6%

TOTALS $ 3,142 $ 344 $ 3,486 100%

As summarized above, $344 million or 10% of the commercial

mortgage loan portfolio is comprised of subordinated notes and

loans, including $310 million of loans secured by fi rst mortgages,

which were fully underwritten and originated by the Company using

its standard underwriting procedures. Senior interests in these fi rst

mortgage loans were then sold to other institutional investors. is

strategy allowed the Company to eff ectively utilize its origination

capabilities to underwrite high quality loans with strong borrower

sponsorship, limit individual loan exposures, and achieve attractive

risk adjusted yields. In the event of a default, the Company would

pursue remedies up to and including foreclosure jointly with the

holders of the senior interests, but would receive repayment only after

satisfaction of the senior interest.