Cigna 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CIGNA CORPORATION 2010 Form 10K 39

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

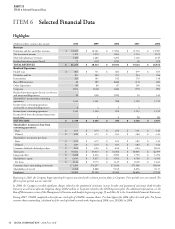

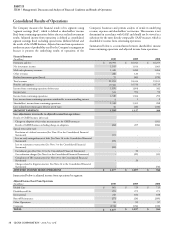

Overview of 2010 Consolidated Results

of Operations

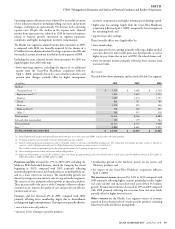

Adjusted income from operations increased 16% in 2010 compared

with 2009 primarily due to strong earnings growth in the

ongoing business segments (Health Care, Disability and Life and

International), refl ecting focused execution of the Company’s strategy,

which includes a growing global customer base as well as higher net

investment income refl ecting improved economic conditions and

asset growth. See the individual segment sections of this MD&A for

further discussion.

Shareholders’ income from continuing operations increased 3% in

2010 compared with 2009, refl ecting strong growth in adjusted

income from operations as explained above as well as signifi cant

improvement in realized investment results, partially off set by a loss

in the GMIB business in 2010 compared with a signifi cant gain in

2009. See the Run-off Reinsurance section of the MD&A beginning

on page 55 for additional information on GMIB results.

Overview of 2009 Consolidated Results

of Operations

Adjusted income from operations increased 16% in 2009 compared

with 2008 primarily refl ecting signifi cantly improved results in the

Run-off Reinsurance segment due to a lower amount of reserve

strengthening required for the GMDB business in 2009 compared

with 2008. is result was primarily due to improved equity market

conditions in 2009. Also, in the aggregate, adjusted income from

operations from the Company’s ongoing operating segments (Health

Care, Disability and Life, and International) improved slightly in

2009 over 2008. ese favorable eff ects were partially off set by higher

unallocated costs (including interest) reported in Corporate.

Shareholders’ income from continuing operations for the year ended

December 31, 2009 was signifi cantly higher than 2008, refl ecting

improved adjusted income from operations, as explained above, as

well as the following:

•substantially improved results in the GMIB business due to

improved equity market conditions and generally higher interest

rates;

•improved realized investment results, also refl ecting better market

conditions during 2009; and

•the favorable year over year impact of the following special items as

detailed in the table above: completion of the IRS examination; the

curtailment gain on the pension plan; and the absence of litigation

charges in 2009.

Special Items and GMIB

Management does not believe that the special items noted in the

table above are representative of the Company’s underlying results

of operations. Accordingly, the Company excluded these special

items from adjusted income from operations in order to facilitate an

understanding and comparison of results of operations and permit

analysis of trends in underlying revenue, expenses and shareholders’

income from continuing operations.

Special items for 2010 included:

•a gain resulting from the resolution of a federal income tax matter,

consisting of a $97 million release of a deferred tax valuation

allowance and $4 million of accrued interest. See Note 20 for

further information;

•a loss on the extinguishment of debt resulting from the decision of

certain holders of the Company’s 8.5% Notes due 2019 and 6.35%

Notes due 2018 to accept the Company’s tender off er to redeem

these Notes for cash. See Note 16 for further information; and

•a loss on reinsurance of the run-off workers’ compensation and

personal accident reinsurance businesses to Enstar. See Note 3 for

further information.

Special items for 2009 included a curtailment gain resulting

from the decision to freeze the pension plan (see Note 10 to the

Consolidated Financial Statements for additional information), cost

reduction charges related to the 2008 cost reduction program (see

the Introduction section of the MD&A beginning on page 33 of

this Form 10-K), and benefi ts resulting from the completion of the

2005 and 2006 IRS examinations (see Note 20 to the Consolidated

Financial Statements for additional information).

Special items for 2008 included a cost reduction charge related to

the 2008 cost reduction program (see the Introduction section of

the MD&A beginning on page 33 of this Form 10-K), a litigation

matter related to the CIGNA Pension Plan (see Note 24 to the

Consolidated Financial Statements for additional information)

reported in Corporate and charges related to certain other litigation

matters, which are reported in the Health Care segment.

e Company also excludes the results of the GMIB business

from adjusted income from operations because the fair value of

GMIB assets and liabilities must be recalculated each quarter using

updated capital market assumptions. e resulting changes in fair

value, which are reported in shareholders’ net income, are volatile

and unpredictable. See the Critical Accounting Estimates section

of the MD&A beginning on page 41 of this Form 10-K for more

information on the eff ect of capital market assumption changes on

shareholders’ net income. Because of this volatility, and since the

GMIB business is in run-off , management does not believe that its

results are meaningful in assessing underlying results of operations.

e loss for the GMIB business in 2010 primarily refl ects the impact

of declining interest rates, partially off set by favorable equity market

performance, whereas the gain in 2009 primarily refl ected increases

in interest rates combined with favorable equity market performance.

See the Run-off Reinsurance section of the MD&A beginning on

page 55 for further information on the GMIB business.

Outlook for 2011

e Company expects 2011 adjusted income from operations to be

approximately level with 2010. is outlook includes an assumption

that GMDB (also known as “VADBe”) results will be approximately

break-even for 2011, which assumes that actual experience, including

capital market performance, will be consistent with long-term reserve

assumptions. See Note 7 to the Consolidated Financial Statements and

the Critical Accounting Estimates section of this MD&A beginning on

page 41 for more information on the potential eff ect of capital market

and other assumption changes on shareholders’ net income.