Cigna 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

108

PART II

ITEM 8 Financial Statements and Supplementary Data

there was no net liability position under such derivative instruments.

See Note 7 for a discussion of derivatives associated with GMDB

contracts and Note 11 for a discussion of derivatives arising from

GMIB contracts. e eff ects of other derivatives were not material

to the Company’s consolidated results of operations, liquidity or

fi nancial condition for the years ended December 31, 2010 and 2009.

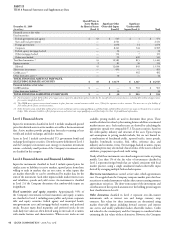

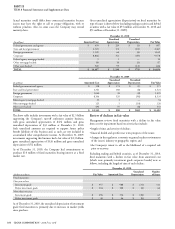

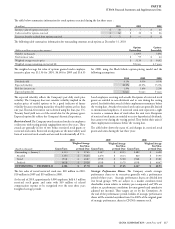

e following tables present information about the nature and

accounting treatment of the Company’s primary derivative fi nancial

instruments including the Company’s purpose for entering

into specifi c derivative transactions, and their locations in and

eff ect on the fi nancial statements as of and for the periods ended

December 31, 2010 and 2009. Derivatives in the Company’s separate

accounts are excluded from the tables because associated gains and

losses generally accrue directly to policyholders.

Instrument/Volume

ofActivity Primary Risk Purpose Cash Flows Accounting Policy

Derivatives Designated as Accounting Hedges-Cash Flow Hedges

Interest rate swaps—

$153million (2010)

and $160million

(2009) of par value of

related investments

Foreign currency

swaps— $159million

(2010) and

$179million (2009)

of U.S. dollar

equivalent par value

of related investments

Combination swaps

(interest rate and

foreign currency)—

$64million (2010)

and $54million

(2009) of U.S. dollar

equivalent par value

of related investments

Interest rate and

foreign currency To hedge the interest and/or

foreign currency cash fl ows of

fi xed maturities and commercial

mortgage loans to match

associated liabilities. Currency

swaps are primarily euros,

Australian dollars, Canadian

dollars and British pounds for

periods of up to 11 years.

e Company periodically

exchanges cash fl ows between

variable and fi xed interest rates

and/or between two currencies for

both principal and interest. Net

interest cash fl ows are reported

in operating activities.

Using cash fl ow hedge accounting,

fair values are reported in other

long-term investments or other

liabilities and accumulated other

comprehensive income and

amortized into net investment

income or reported in other

realized investment gains and

losses as interest or principal

payments are received.

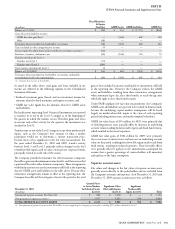

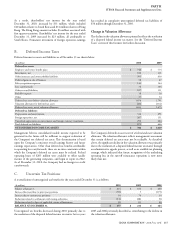

Fair Value E ect on the Financial Statements (in millions)

Instrument

Other Long-Term Investments Accounts Payable, Accrued

Expenses and Other Liabilities

Gain (Loss)

Recognized in Other

Comprehensive Income

(1)

As of December31, As of December31, For the years ended December31,

2010 2009 2010 2009 2010 2009

Interest rate swaps $ 10$8$ -$ -$2$(5)

Foreign currency

swaps 6 4 20 24 10 (24)

Interest rate

and foreign

currency swaps - - 12 6 (7) (12)

TOTAL $16$12$32$30$5$41

(1) Other comprehensive income for foreign currency swaps excludes amounts required to adjust future policy benefits for the run-off settlement annuity business.

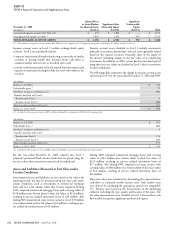

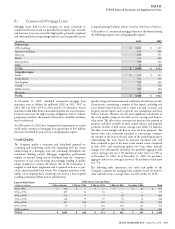

Purchased options—

$312million

ofcash surrender

value ofrelated life

insurance policies

Interest rate To hedge the possibility of early

policyholder cash surrender when

the amortized cost of underlying

invested assets is greater than their

fair values.

e Company pays a fee and may

receive or pay cash, based on the

diff erence between the amortized

cost and fair values of underlying

invested assets at the time of

policyholder surrender. ese cash

fl ows will be reported in fi nancing

activities.

Using cash fl ow hedge accounting,

fair values are reported in other

assets or other liabilities, with

changes in fair value reported in

accumulated other comprehensive

income and amortized to other

benefi t expenses over the life of

the underlying invested assets.

Fair Value E ect on the Financial Statements

Fair values reported in other assets and other comprehensive income were not signifi cant.

Treasury lock Interest rate To hedge the variability of and fi x

at inception date, the benchmark

Treasury rate component of future

interest payments on debt to be

issued.

e Company paid the fair value

of the contract at the expiration.

Cash fl ows were reported in

operating activities.

Using cash fl ow hedge accounting,

fair values are reported in

other assets or other liabilities,

with changes in fair value

reported in accumulated other

comprehensive income and

amortized to interest expense over

the period of expected cash fl ows.

Fair Value E ect on the Financial Statements

In the fi rst quarter of 2009, all treasury locks matured and the Company recognized a gain of $14 million in other

comprehensive income, resulting in net cumulative losses of $26 million, to be amortized to interest expense over the life of the

debt. In the second quarter of 2009, the Company issued debt and began amortizing this loss to interest expense over the period

of expected cash fl ows.

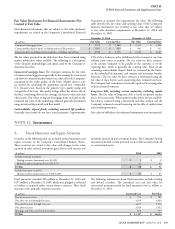

e amount of gains (losses) reclassifi ed from accumulated other

comprehensive income into income was not signifi cant. No gains

(losses) were recognized due to ineff ectiveness and no amounts were

excluded from the assessment of hedge ineff ectiveness.