Cigna 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CIGNA CORPORATION 2010 Form 10K

88

PART II

ITEM 8 Financial Statements and Supplementary Data

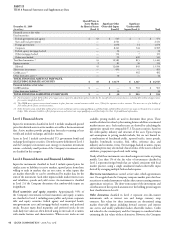

In 2000, the Company determined that the GMDB reinsurance

business was premium defi cient because the recorded future policy

benefi t reserve was less than the expected present value of future claims

and expenses less the expected present value of future premiums and

investment income using revised assumptions based on actual and

expected experience. e Company tests for premium defi ciency by

reviewing its reserve each quarter using current market conditions and

its long-term assumptions. Under premium defi ciency accounting,

if the recorded reserve is determined insuffi cient, an increase to the

reserve is refl ected as a charge to current period income. Consistent

with GAAP, the Company does not recognize gains on premium

defi cient long duration products.

e Company had future policy benefi t reserves for GMDB

contracts of $1.1 billion as of December 31, 2010, and $1.3 billion

as of December 31, 2009. e determination of liabilities for GMDB

requires the Company to make critical accounting estimates. e

Company estimates its liabilities for GMDB exposures using a complex

internal model run using many scenarios and based on assumptions

regarding lapse, future partial surrenders, claim mortality (deaths that

result in claims), interest rates (mean investment performance and

discount rate) and volatility. Lapse refers to the full surrender of an

annuity prior to a contractholder’s death. Future partial surrender

refers to the fact that most contractholders have the ability to withdraw

substantially all of their mutual fund investments while retaining the

death benefi t coverage in eff ect at the time of the withdrawal. Mean

investment performance for underlying equity mutual funds refers

to market rates expected to be earned on the hedging instruments

over the life of the GMDB equity hedge program, and for underlying

fi xed income mutual funds refers to the expected market return over

the life of the contracts. Market volatility refers to market fl uctuation.

ese assumptions are based on the Company’s experience and

future expectations over the long-term period, consistent with the

long-term nature of this product. e Company regularly evaluates

these assumptions and changes its estimates if actual experience or

other evidence suggests that assumptions should be revised. If actual

experience diff ers from the assumptions (including lapse, future

partial surrenders, claim mortality, interest rates and volatility)

used in estimating these liabilities, the result could have a material

adverse eff ect on the Company’s consolidated results of operations,

and in certain situations, could have a material adverse eff ect on the

Company’s fi nancial condition.

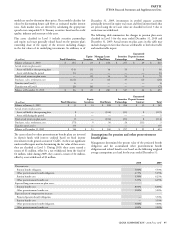

e following provides information about the Company’s reserving

methodology and assumptions for GMDB as of December 31, 2010:

• e reserves represent estimates of the present value of net

amounts expected to be paid, less the present value of net future

premiums. Included in net amounts expected to be paid is the

excess of the guaranteed death benefi ts over the values of the

contractholders’ accounts (based on underlying equity and bond

mutual fund investments).

• e reserves include an estimate for partial surrenders that

essentially lock in the death benefi t for a particular policy based on

annual election rates that vary from 0 to 15% depending on the net

amount at risk for each policy and whether surrender charges apply.

• e assumed mean investment performance for the underlying

equity mutual funds considers the Company’s GMDB equity hedge

program using futures contracts, and is based on the Company’s view

that short-term interest rates will average 5% over future periods,

but considers that current short-term rates are less than 5%. e

mean investment performance assumption for the underlying fi xed

income mutual funds (bonds and money market) is 5% based on

a review of historical returns. e investment performance for

underlying equity and fi xed income mutual funds is reduced by

fund fees ranging from 1 to 3% across all funds.

• e volatility assumption is based on a review of historical monthly

returns for each key index (e.g. S&P 500) over a period of at least

ten years. Volatility represents the dispersion of historical returns

compared to the average historical return (standard deviation) for

each index. e assumption is 16% to 26%, varying by equity fund

type; 4% to 10%, varying by bond fund type; and 2% for money

market funds. ese volatility assumptions are used along with the

mean investment performance assumption to project future return

scenarios.

• e discount rate is 5.75%.

• e claim mortality assumption is 65% to 89% of the 1994 Group

Annuity Mortality table, with 1% annual improvement beginning

January 1, 2000. e assumption refl ects that for certain contracts,

a spousal benefi ciary is allowed to elect to continue a contract by

becoming its new owner, thereby postponing the death claim rather

than receiving the death benefi t currently. For certain issuers of

these contracts, the claim mortality assumption depends on age,

gender, and net amount at risk for the policy.

• e lapse rate assumption is 0% to 24%, depending on contract

type, policy duration and the ratio of the net amount at risk to

account value.

During 2010, the Company performed its periodic review of

assumptions resulting in a charge of $52 million pre-tax ($34 million

after-tax) to strengthen GMDB reserves. During 2010, current

short-term interest rates had declined from the level anticipated

at December 31, 2009, leading the Company to increase reserves.

Interest rate risk is not covered by the GMDB equity hedge program

discussed above. e Company also updated the lapse assumption

for policies that have already taken or may take a signifi cant partial

withdrawal, which had a lesser reserve impact.

During 2009, the Company reported a charge of $73 million pre-tax

($47 million after-tax) to strengthen GMDB reserves. e reserve

strengthening primarily refl ected an increase in the provision for

future partial surrenders due to market declines, adverse volatility-

related impacts due to turbulent equity market conditions, and

interest rate impacts.

During 2008, the Company recorded additional benefi ts expenses of

$406 million pre-tax ($263 million after-tax) to strengthen GMDB

reserves following an analysis of experience and reserve assumptions.

e amounts were primarily due to adverse impacts of overall market

declines of $210 million pre-tax ($136 million after-tax), adverse

volatility-related impacts due to turbulent equity market conditions

totaling $182 million pre-tax ($118 million after-tax) and adverse

interest rate impacts of $14 million pre-tax ($9 million after-tax).