Cigna 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CIGNA CORPORATION 2010 Form 10K

40

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Information is not available for management to reasonably estimate

the future results of the GMIB business or realized investment results

due in part to interest rate and stock market volatility and other

internal and external factors. In addition, the Company is not able to

identify or reasonably estimate the fi nancial impact of special items in

2011 however they may include potential adjustments associated with

cost reduction, litigation, tax and assessment-related matters.

e Company’s outlook for 2011 is subject to the factors cited

above and in the Cautionary Statement beginning on page 70

of this Form 10-K and the sensitivities discussed in the Critical

Accounting Estimates section of the MD&A beginning on page 41

of this Form 10-K. If unfavorable equity market and interest rate

movements occur, the Company could experience losses related to

investment impairments and the GMIB and GMDB businesses.

ese losses could adversely impact the Company’s consolidated

results of operations and fi nancial condition by potentially reducing

the capital of the Company’s insurance subsidiaries and reducing

their dividend-paying capabilities.

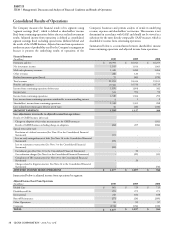

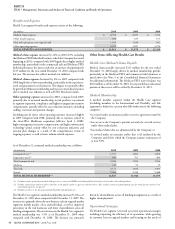

Revenues

Total revenues increased by 15% in 2010, compared with 2009,

and decreased by 4% in 2009 compared with 2008. Changes in the

components of total revenue are described in more detail below.

Premiums and Fees

Premiums and fees increased by 15% in 2010, compared with 2009,

primarily refl ecting membership growth in the Health Care segment’s

risk businesses as well as growth in the International segment.

Premiums and fees increased by 10% in 2010 compared with 2009

after excluding the Medicare Private Fee for Service (“Medicare

PFFS”) Individual business, from which the Company has exited

beginning in 2011.

Premiums and fees decreased by 1% in 2009, compared with 2008,

primarily refl ecting membership declines in Health Care resulting

from higher unemployment and the unfavorable eff ect of foreign

currency translation in International, off set by the absence of

premium and fees from Great West Healthcare in the fi rst quarter of

2008 since this business was acquired April 1, 2008.

Net Investment Income

Net investment income increased by 9% in 2010, compared with

2009, primarily refl ecting improved results from security partnerships

and real estate investments and higher assets due to business growth,

partially off set by lower reinvestment yields.

Net investment income decreased by 5% in 2009, compared with

2008, primarily refl ecting lower income from real estate investments

and security partnerships, unfavorable foreign exchange rates and

lower investment yields, partially off set by higher invested assets due

to business growth.

Mail Order Pharmacy Revenues

Mail order pharmacy revenues increased by 11% in 2010, compared

with 2009, primarily refl ecting increases in volume and, to a lesser

extent, price increases and by 6% in 2009, compared with 2008,

primarily due to price increases.

Other Revenues

Other revenues include the impact of futures contracts associated

with the GMDB equity hedge program. Losses on futures contracts

refl ect stock market gains, whereas gains refl ect stock market losses.

e Company reported losses associated with the GMDB equity

hedge program of $157 million in 2010 and $282 million in 2009

compared with gains of $333 million in 2008. Excluding the impact

of the futures contracts associated with the GMDB equity hedge

program, Other revenues increased 4% in 2010, compared with

2009 primarily refl ecting the pre-tax gain on the sale of the workers’

compensation and case management business of $18 million.

Excluding the impact of the futures contracts associated with the

GMDB equity hedge program, Other revenues decreased 4% in 2009,

compared with 2008, primarily refl ecting declines in amortization of

deferred gains on the sales of the retirement benefi ts and individual

life insurance and annuity business.

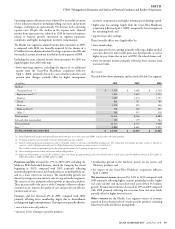

Realized Investment Results

Realized investment results in 2010 were signifi cantly higher than in

2009 primarily due to:

•lower impairments on fi xed maturities and real estate funds in 2010;

•increased prepayment fees on fi xed maturities received in 2010 as

a result of favorable market conditions and issuer specifi c business

circumstances; and

•gains on sales of real estate held in joint ventures and other

investments in 2010.

ese favorable eff ects were partially off set by an increase in

commercial mortgage loan impairments recorded in 2010, refl ecting

continued weakness in the commercial real estate market.

Realized investment results in 2009 were signifi cantly improved

compared to 2008, primarily due to:

•lower asset write-downs on fi xed maturities largely refl ecting

improved market conditions;

•gains on sales of fi xed maturities and equities in 2009 compared

with losses in 2008; and

•gains on hybrid securities in 2009 compared with losses in 2008

(changes in fair value for these securities are reported in realized

investment results).

ese favorable eff ects were partially off set by higher impairments of

investments in real estate entities and commercial mortgage loans in

2009 due to the impact of the continued weak economic environment

on the commercial real estate market and the absence of signifi cant

gains on the sales of real estate ventures reported during 2008.

See Note 15 to the Consolidated Financial Statements for additional

information.