Cigna 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

106

PART II

ITEM 8 Financial Statements and Supplementary Data

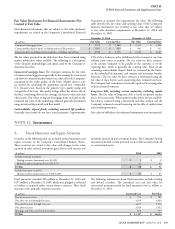

e Company’s annual in-depth review of its commercial mortgage

loan investments is the primary mechanism for identifying emerging

risks in the portfolio. is review is performed by the Company’s

investment professionals and includes an analysis of each underlying

property’s most recent annual fi nancial statements, rent rolls,

operating plans, budgets, a physical inspection of the property and

other pertinent factors. Based on historical results, current leases,

lease expirations and rental conditions in each market, the Company

estimates the current year and future stabilized property income and

fair value, and categorizes the investments as loans in good standing,

potential problem loans or problem loans. Quality ratings are adjusted

between annual reviews if new property information is received or

events such as delinquency or a borrower request for restructure cause

management to believe that the Company’s estimate of fi nancial

performance, fair value or the risk profi le of the underlying property

has been impacted.

Potential problem mortgage loans are considered current (no

payment more than 59 days past due), but exhibit certain

characteristics that increase the likelihood of future default. e

characteristics management considers include, but are not limited

to, the deterioration of debt service coverage below 1.0, estimated

loan-to-value ratios increasing to 100% or more, downgrade in

quality rating and request from the borrower for restructuring. In

addition, loans are considered potential problems if principal or

interest payments are past due by more than 30 but less than 60 days.

Problem mortgage loans are either in default by 60 days or more or

have been restructured as to terms, which could include concessions

on interest rate, principal payment or maturity date. e Company

monitors each problem and potential problem mortgage loan on an

ongoing basis, and updates the loan categorization and quality rating

when warranted.

Problem and potential problem mortgage loans totaled $383 million

at December 31, 2010 and $397 million at December 31, 2009, with

no signifi cant concentrations by property type or geographic region

in either year.

Impaired Commercial Mortgage Loans

A commercial mortgage loan is considered impaired when it is

probable that the Company will not collect all amounts due (principal

and interest) according to the terms of the original loan agreement. e

Company assesses each loan individually for impairment, utilizing the

information obtained from the quality review process discussed above.

Impaired loans are carried at the lower of unpaid principal balance or

the fair value of the underlying collateral. Certain commercial mortgage

loans without valuation reserves are considered impaired because the

Company will not collect all interest due according to the terms of

the original agreements; however, the Company does expect to recover

their remaining carrying value primarily because it is less than the fair

value of the underlying property.

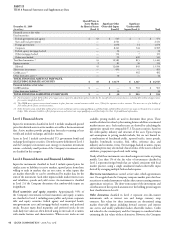

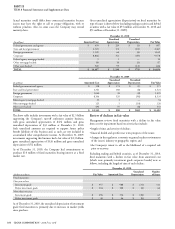

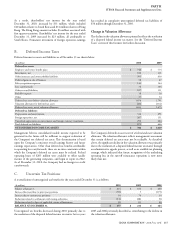

As of December 31, the carrying value of the Company’s impaired

commercial mortgage loans and related valuation reserves were as

follows:

(In millions)

2010 2009

Gross Reserves Net Gross Reserves Net

Impaired commercial mortgage loans with valuation reserves $ 47 $ (12) $ 35 $ 143 $ (17) $ 126

Impaired commercial mortgage loans with no valuation reserves 60 — 60 96 — 96

TOTAL $ 107 $ 12 $ 95 $ 239 $ 17 $ 222

During 2010, the Company recorded a $24 million pre-tax

($15 million after-tax) increase in valuation reserves on impaired

commercial mortgage loans primarily due to decreased valuations of

certain offi ce properties collateralizing the loans. e average recorded

investment in impaired loans was $169 million during 2010 and

$116 million during 2009. e Company recognizes interest income

on problem mortgage loans only when payment is actually received

because of the risk profi le of the underlying investment. Interest

income that would have been refl ected in net income if interest

on non-accrual commercial mortgage loans had been received in

accordance with the original terms was not signifi cant for 2010 or

2009. Interest income on impaired commercial mortgage loans was

not signifi cant for 2010 or 2009.

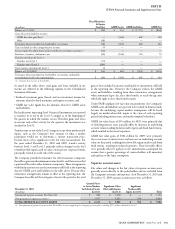

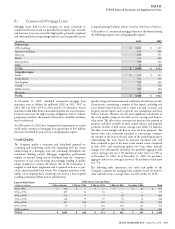

e following table summarizes the changes in valuation reserves for

commercial mortgage loans:

(In millions)

2010 2009

Reserve balance, January 1, $17 $—

Increase in valuation reserves 24 17

Charge-off s upon sales and repayments, net of recoveries (12) —

Transfers to foreclosed real estate (17) —

RESERVE BALANCE, DECEMBER31, $ 12 $ 17

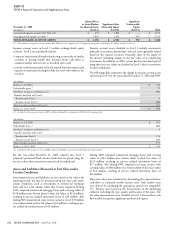

C. Real Estate

As of December 31, 2010 and 2009, real estate investments consisted

primarily of offi ce and industrial buildings in California. Investments

with a carrying value of $49 million as of December 31, 2010 and

$55 million as of December 31, 2009 were non-income producing

during the preceding twelve months. As of December 31, 2010,

the Company had commitments to contribute additional equity of

$11 million to real estate investments.