Cigna 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

54

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

International Segment

Segment Description

e International segment includes supplemental health, life and

accident insurance products and international health care products

and services, including those off ered to expatriate employees of

multinational corporations and other organizations.

e key factors for this segment are:

•premium growth, including new business and customer retention;

•benefi ts expense as a percentage of earned premium (loss ratio);

•operating expense as a percentage of earned premium (expense

ratio); and

•impact of foreign currency movements.

Results of Operations

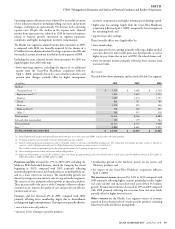

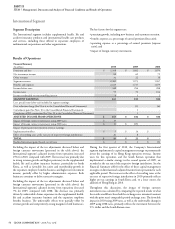

Financial Summary

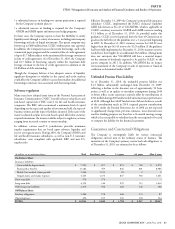

(In millions)

2010 2009 2008

Premiums and fees $ 2,268 $ 1,882 $ 1,870

Net investment income 82 69 79

Other revenues 31 22 18

Segment revenues 2,381 1,973 1,967

Benefi ts and expenses 2,039 1,717 1,679

Income before taxes 342 256 288

Income taxes 95 70 104

Income attributable to noncontrolling interest 4 3 2

SEGMENT EARNINGS 243 183 182

Less: special items (after-tax) included in segment earnings:

Cost reduction charge (See Note 6 to the Consolidated Financial Statements) - (1) (6)

Curtailment gain (See Note 10 to the Consolidated Financial Statements) - 1 -

Completion of IRS examination (See Note 20 to the Consolidated Financial Statements) - 1 -

ADJUSTED INCOME FROM OPERATIONS $ 243 $ 182 $ 188

Impact of foreign currency movements using 2009 rates $ 13

Impact of foreign currency movements using 2008 rates $ 11 $ (15)

Impact of permanent investment in overseas earnings:

Implementation eff ect $ 5 $ 14 $ -

Eff ect of recording taxes at the tax rates of respective foreign jurisdictions 25 8-

TOTAL $30 $22 $

Realized investment gains (losses), net of taxes $ 2 $ 2 $ (3)

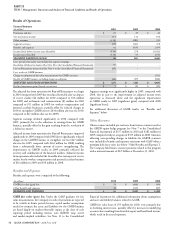

Excluding the impact of the tax adjustments discussed below and

foreign currency movements (presented in the table above), the

International segment’s adjusted income from operations increased

25% for 2010, compared with 2009. e increase was primarily due

to strong revenue growth and higher persistency in the supplemental

health, life and accident insurance business, particularly in South

Korea, as well as favorable loss ratios and membership growth in

the expatriate employee benefi ts business and higher net investment

income, partially off set by higher administrative expenses. Both

businesses continue to deliver attractive margins.

Excluding the impact of the tax adjustments discussed below and

foreign currency movements (presented in the table above), the

International segment’s adjusted income from operations decreased

7% for 2009, compared with 2008. e decrease was primarily

driven by unfavorable claims experience in the supplemental health,

life and accident insurance business and the expatriate employee

benefi ts business. e unfavorable eff ects were partially off set by

revenue growth and competitively strong margins in both businesses.

During the fi rst quarter of 2010, the Company’s International

segment implemented a capital management strategy to permanently

invest the earnings of its Hong Kong operation overseas. Income

taxes for this operation, and the South Korean operation that

implemented a similar strategy in the second quarter of 2009, are

recorded at the tax rate of the respective foreign jurisdiction. See the

Financial Summary table for the eff ect of these capital management

strategies on International’s adjusted income from operations for each

applicable period. e increase in the eff ect of recording taxes at the

tax rates of respective foreign jurisdictions in 2010 primarily refl ects

higher pre-tax earnings in South Korea and, to a lesser extent, the

addition of Hong Kong in 2010.

roughout this discussion, the impact of foreign currency

movements was calculated by comparing the reported results to what

the results would have been had the exchange rates remained constant

with the prior year’s comparable period exchange rates. e favorable

impact in 2010 using 2009 rates, as well as the unfavorable change in

2009 using 2008 rates, primarily refl ects the movement between the

U.S. dollar and the South Korean won.