Cigna 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

92

PART II

ITEM 8 Financial Statements and Supplementary Data

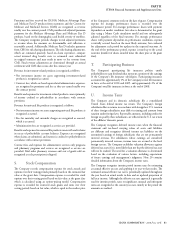

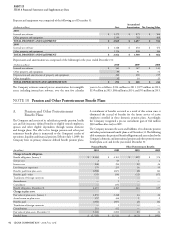

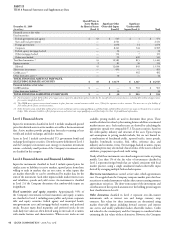

Property and equipment was comprised of the following as of December 31:

(Dollars in millions)

Cost Accumulated

Amortization Net Carrying Value

2010

Internal-use software $ 1,379 $ 875 $ 504

Other property and equipment 1,190 782 408

TOTAL PROPERTY AND EQUIPMENT $ 2,569 $ 1,657 $ 912

2009

Internal-use software $ 1,168 $ 692 $ 476

Other property and equipment 1,194 808 386

TOTAL PROPERTY AND EQUIPMENT $ 2,362 $ 1,500 $ 862

Depreciation and amortization was comprised of the following for the years ended December 31:

(Dollars in millions)

2010 2009 2008

Internal-use software $ 161 $ 147 $ 143

Other property and equipment 99 91 76

Depreciation and amortization of property and equipment 260 238 219

Other intangibles 32 30 25

TOTAL DEPRECIATION AND AMORTIZATION $ 292 $ 268 $ 244

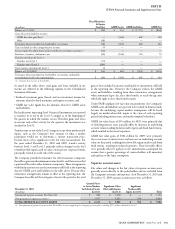

e Company estimates annual pre-tax amortization for intangible

assets, including internal-use software, over the next fi ve calendar years to be as follows: $214 million in 2011, $179 million in 2012,

$139 million in 2013, $84 million in 2014, and $53 million in 2015.

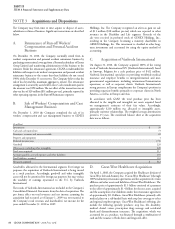

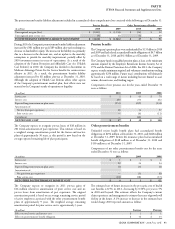

NOTE 10 Pension and Other Postretirement Benefi t Plans

A. Pension and Other Postretirement

Benefi t Plans

e Company and certain of its subsidiaries provide pension, health

care and life insurance defi ned benefi ts to eligible retired employees,

spouses and other eligible dependents through various domestic

and foreign plans. e eff ect of its foreign pension and other post

retirement benefi t plans is immaterial to the Company’s results of

operations, liquidity and fi nancial position. Eff ective July 1, 2009, the

Company froze its primary domestic defi ned benefi t pension plans.

A curtailment of benefi ts occurred as a result of this action since it

eliminated the accrual of benefi ts for the future service of active

employees enrolled in these domestic pension plans. Accordingly,

the Company recognized a pre-tax curtailment gain of $46 million

($30 million after-tax) in 2009.

e Company measures the assets and liabilities of its domestic pension

and other postretirement benefi t plans as of December 31. e following

table summarizes the projected benefi t obligations and assets related to the

Company’s domestic and international pension and other postretirement

benefi t plans as of, and for the year ended, December 31:

(In millions)

Pension Bene ts Other Postretirement Bene ts

2010 2009 2010 2009

Change in bene t obligation

Benefi t obligation, January 1 $ 4,363 $ 4,101 $ 419 $ 376

Service cost 2 43 1 1

Interest cost 240 250 22 24

Loss from past experience 379 255 36 59

Benefi ts paid from plan assets (258) (247) (2) (4)

Benefi ts paid - other (35) (30) (32) (37)

Translation of foreign currencies — 1 — —

Amendments — 5 — —

Curtailment — (15) — —

Benefi t obligation, December 31 4,691 4,363 444 419

Change in plan assets

Fair value of plan assets, January 1 2,850 2,248 24 24

Actual return on plan assets 357 436 1 2

Benefi ts paid (258) (247) (2) (2)

Translation of foreign currencies — 1 — —

Contributions 214 412 — —

Fair value of plan assets, December 31 3,163 2,850 23 24

Funded Status $ (1,528) $ (1,513) $ (421) $ (395)