Cigna 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CIGNA CORPORATION 2010 Form 10K 55

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

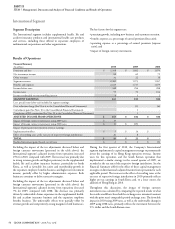

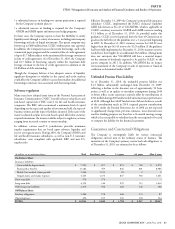

Revenues

Premiums and fees. Excluding the eff ect of foreign currency

movements, premiums and fees were $2.2 billion in 2010, compared

with reported premiums and fees of $1.9 billion in 2009, an increase

of 16%. e increase was primarily attributable to new sales growth

in the supplemental health, life and accident insurance operations,

particularly in South Korea, and rate increases and membership

growth in the expatriate employee benefi ts business. Excluding

the eff ect of foreign currency movements, premiums and fees were

$2.0 billion in 2009, compared with reported premiums and fees of

$1.9 billion in 2008, an increase of 9%. e increase was primarily

attributable to new sales growth in the supplemental health, life and

accident insurance operations, particularly in Taiwan and South

Korea, and rate actions in the expatriate employee benefi ts business.

Net investment income increased by 19% in 2010, compared with

2009. e increase was primarily due to favorable foreign currency

movements and asset growth, particularly in South Korea. Net

investment income decreased by 13% in 2009, compared with 2008.

e decrease was primarily due to unfavorable foreign currency

movements, primarily in South Korea.

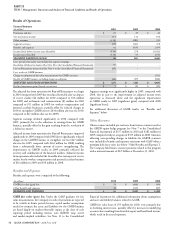

Benefi ts and Expenses

Excluding the impact of foreign currency movements, benefi ts and

expenses were $2.0 billion in 2010, compared with reported benefi ts

and expenses of $1.7 billion in 2009, an increase of 15%. ese

increases were primarily due to business growth and higher claims

in the supplemental health, life and accident insurance business,

particularly in South Korea. Excluding the impact of foreign currency

movements, benefi ts and expenses were $1.8 billion in 2009,

compared with reported benefi ts and expenses of $1.7 billion in

2008, an increase of 9%. e increase was primarily driven by higher

loss ratios, business growth, and increased amortization of deferred

acquisition costs.

Loss ratios were higher in the supplemental health, life and accident

insurance business in 2010, compared with 2009, refl ecting less

favorable claims experience. Loss ratios were lower in the expatriate

benefi ts business in 2010, compared with 2009, refl ecting favorable

claim experience and rate increases on renewal business.

Policy acquisition expenses increased in 2010, compared with 2009,

refl ecting business growth and foreign currency movements. Policy

acquisition costs decreased in 2009, compared to 2008, refl ecting

foreign currency movements partially off set by business growth

and higher amortization of acquisition costs associated with lower

persistency in the supplemental health, life and accident insurance

business.

Expense ratios increased in 2010, compared with 2009, refl ecting

the acquisition costs associated with the purchase of Vanbreda

International as well as the impact of the higher expense ratios

associated with the acquired business. Expense ratios decreased in

2009, compared with 2008, refl ecting eff ective expense management.

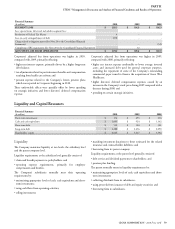

Other Items Aff ecting International Results

For the Company’s International segment, South Korea is the

single largest geographic market. South Korea generated 32% of

the segment’s revenues and 49% of the segment’s earnings in 2010.

South Korea generated 29% of the segment’s revenues and 49% of

the segment’s earnings in 2009. Due to the concentration of business

in South Korea, the International segment is exposed to potential

losses resulting from economic and geopolitical developments in

that country, as well as foreign currency movements aff ecting the

South Korean currency, which could have a signifi cant impact on the

segment’s results and the Company’s consolidated fi nancial results.

As discussed in Note 3 to the Consolidated Financial Statements,

the Company acquired Vanbreda International in August of 2010.

is acquisition further strengthens CIGNA International’s position

in the expatriate benefi ts market. Since the acquisition, earnings from

Vanbreda International have been immaterial to results of operations.

e Company expects Vanbreda International’s earnings to be

accretive in 2011.

In China, CIGNA International owns a 50% interest in a joint

venture through which its products and services are off ered. e

Company accounts for this joint venture using the equity method,

recording its share of the joint venture’s net income in other revenues.

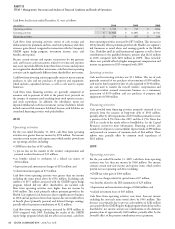

Run-off Reinsurance Segment

Segment Description

e Company’s reinsurance operations were discontinued and are

now an inactive business in run-off mode since the sale of the U.S.

individual life, group life and accidental death reinsurance business in

2000. is segment is predominantly comprised of GMDB, GMIB,

workers’ compensation and personal accident reinsurance products.

On December 31, 2010, the Company essentially exited from its

workers compensation and personal accident reinsurance business

by purchasing retrocessional coverage from a Bermuda subsidiary of

Enstar Group Limited and transferring the ongoing administration

of this business to the reinsurer. e 2010 special item loss refl ects the

after-tax costs of this transaction.

e determination of liabilities for GMDB and GMIB requires

the Company to make critical accounting estimates. In 2008, the

Company updated the assumptions for GMIB and the eff ects of

hypothetical changes in those assumptions in connection with the

implementation of the FASB’s fair value disclosure and measurement

guidance (ASC 820). e Company describes the assumptions used

to develop the reserves for GMDB in Note 7 to the Consolidated

Financial Statements and for the assets and liabilities associated with

GMIB in Note 11 to the Consolidated Financial Statements. e

Company also provides the eff ects of hypothetical changes in those

assumptions in the Critical Accounting Estimates section of the

MD&A beginning on page 41 of this Form 10-K.

e Company excludes the results of the GMIB business from

adjusted income from operations because the fair value of GMIB

assets and liabilities must be recalculated each quarter using updated

capital market assumptions. e resulting changes in fair value,

which are reported in shareholders’ net income, are volatile and

unpredictable.