Cigna 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 95

PART II

ITEM 8 Financial Statements and Supplementary Data

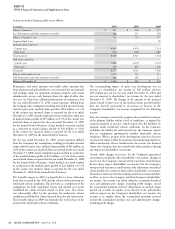

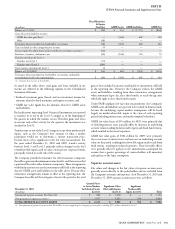

models are used to determine these prices. ese models calculate fair

values by discounting future cash fl ows at estimated market interest

rates. Such market rates are derived by calculating the appropriate

spreads over comparable U.S. Treasury securities, based on the credit

quality, industry and structure of the asset.

Plan assets classifi ed in Level 3 include securities partnerships

and equity real estate generally valued based on the pension plan’s

ownership share of the equity of the investee including changes

in the fair values of its underlying investments. In addition, as of

December 31, 2009, investments in pooled separate accounts

principally invested in equity real estate and fi xed income funds that

are priced using the net asset value are classifi ed in Level 3 due to

restrictions on withdrawal.

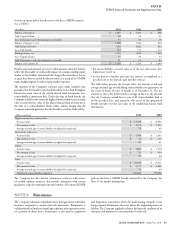

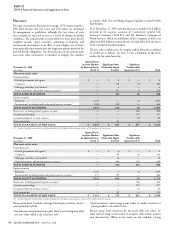

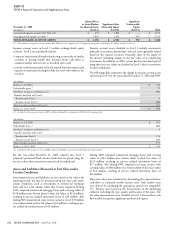

e following table summarizes the changes in pension plan assets

classifi ed in Level 3 for the years ended December 31, 2010 and

December 31, 2009. Actual return on plan assets in this table may

include changes in fair value that are attributable to both observable

and unobservable inputs.

(In millions)

Fixed Maturities Equity

Securities Mortgage Loans

&Real Estate Securities

Partnerships

Guaranteed

Deposit Account

Contract Total

Balance at January 1, 2010 $ 144 $ 23 $ 160 $ 257 $ 29 $ 613

Actual return on plan assets:

Assets still held at the reporting date (14) (1) 16 53 2 56

Assets sold during the period 14————14

Total actual return on plan assets — (1) 16 53 2 70

Purchases, sales, settlements, net (121) 2 64 37 (7) (25)

Transfers into Level 3 6———— 6

Transfers out of Level 3 (3) (4)———(7)

Balance at December 31, 2010 $ 26 $ 20 $ 240 $ 347 $ 24 $ 657

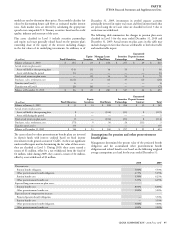

(In millions)

Fixed Maturities Equity

Securities Real Estate Securities

Partnerships

Guaranteed

Deposit Account

Contract Total

Balance at January 1, 2009 $ 31 $ 14 $ 208 $ 264 $ 32 $ 549

Actual return on plan assets:

Assets still held at the reporting date 8 — (104) (31) 8 (119)

Assets sold during the period 5 — — — — 5

Total actual return on plan assets 13 — (104) (31) 8 (114)

Purchases, sales, settlements, net (75) 9 56 24 (11) 3

Transfers into Level 3 175 — — — — 175

Balance at December 31, 2009 $ 144 $ 23 $ 160 $ 257 $ 29 $ 613

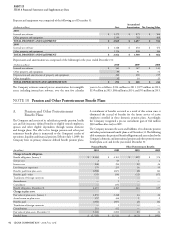

e assets related to other postretirement benefi t plans are invested

in deposit funds with interest credited based on fi xed income

investments in the general account of CGLIC. As there are signifi cant

unobservable inputs used in determining the fair value of these assets,

they are classifi ed as Level 3. During 2010, these assets earned a

return of $1 million, off set by a net withdrawal from the fund of

$2 million, while during 2009, they earned a return of $2 million,

off set by a net withdrawal of $2 million.

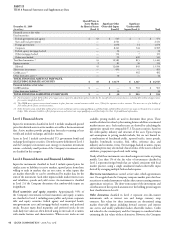

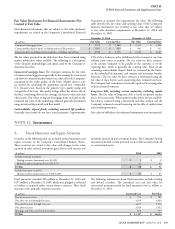

Assumptions for pension and other postretirement

benefi t plans

Management determined the present value of the projected benefi t

obligation and the accumulated other postretirement benefi t

obligation and related benefi t costs based on the following weighted

average assumptions as of and for the years ended December 31:

2010 2009

Discount rate:

Pension benefi t obligation 5.00% 5.50%

Other postretirement benefi t obligation 4.75% 5.25%

Pension benefi t cost 5.50% 6.25%

Other postretirement benefi t cost 5.25% 6.25%

Expected long-term return on plan assets:

Pension benefi t cost 8.00% 8.00%

Other postretirement benefi t cost 5.00% 5.00%

Expected rate of compensation increase:

Projected pension benefi t obligation — 3.50%

Pension benefi t cost — 3.50%

Other postretirement benefi t obligation 3.00% 3.00%

Other postretirement benefi t cost 3.00% 3.00%