Cigna 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 45

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Balance Sheet Caption/Nature of Critical

Accounting Estimate Assumptions/Approach Used E ect if Di erent Assumptions Used

Accounts payable, accrued expenses and other

liabilities, and Other assets including other

intangibles — Guaranteed minimum income

benefi ts (continued)

If credit default swap spreads used to evaluate

the nonperformance risk of the Company’s

GMIB retrocessionaires were to widen or the

retrocessionaires’ credit ratings were to weaken, it

would cause an increase in the discount rate of the

GMIB asset, resulting in an unfavorable impact

to earnings. If the discount rate increased by 25

bps due to this, the decrease in shareholders’ net

income would be approximately $2 million.

All of these estimated impacts due to unfavorable

changes in assumptions could vary from quarter

to quarter depending on actual reserve levels,

the actual market conditions or changes in

the anticipated view of a hypothetical market

participant as of any future valuation date.

e amounts would be refl ected in the Run-off

Reinsurance segment in GMIB expense.

Accounts payable, accrued expenses and other

liabilities — pension liabilities

ese liabilities are estimates of the present value

of the qualifi ed and nonqualifi ed pension benefi ts

to be paid (attributed to employee service to date)

net of the fair value of plan assets. e accrued

pension benefi t liability as of December 31 was as

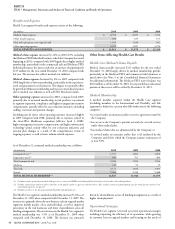

follows (in millions):

•2010— $1,528

•2009 — $1,513

See Note 10 to the Consolidated Financial

Statements for additional information.

e Company estimates these liabilities and

the related expense with actuarial models using

various assumptions including discount rates and

an expected long-term return on plan assets.

Discount rates are set by applying actual

annualized yields at various durations from

the Citigroup Pension Liability curve, without

adjustment, to the expected cash fl ows of the

pension liabilities.

e expected long-term return on plan assets for

the domestic qualifi ed pension plan is developed

considering actual historical returns, expected

long-term market conditions, plan asset mix and

management’s investment strategy. In addition,

to measure pension costs the Company uses a

market-related asset value method for domestic

qualifi ed pension plan assets invested in non-fi xed

income investments, which are approximately

80% of total plan assets. is method recognizes

the diff erence between actual and expected

returns in the non-fi xed income portfolio over

5 years, a method that reduces the short-term

impact of market fl uctuations on pension cost.

At December 31, 2010, the market-related asset

value was approximately $3.4 billion compared

with a market value of $3.2 billion.

e accumulated unrecognized actuarial loss of

$1.8 billion at December 31, 2010 primarily

refl ects the signifi cant decline in the value of

equity securities during 2008 and, to a lesser

extent, a decline in the discount rate and change

in mortality assumption during 2010. e

actuarial loss is adjusted for unrecognized changes

in market-related asset values and amortized over

the average remaining life expectancy of plan

participants if the adjusted loss exceeds 10% of

the market-related value of plan assets or 10%

of the projected benefi t obligation, whichever is

greater. As of December 31, 2010, approximately

$1.1 billion of the adjusted actuarial loss exceeded

10% of the projected benefi t obligation. As a

result, approximately $25 million after-tax of

the unrecognized loss will be expensed in 2011

shareholders’ net income. For the year ended

December 31, 2010, $18 million after-tax of the

unrecognized loss was expensed in shareholders’

net income.

Using past experience, the Company expects

that it is reasonably possible that a favorable or

unfavorable change in these key assumptions

of 50 basis points could occur. An unfavorable

change is a decrease in these key assumptions with

resulting impacts as discussed below.

If discount rates for the qualifi ed and

nonqualifi ed pension plans decreased by 50 basis

points:

• annual pension costs for 2011 would decrease

by approximately $3 million, after-tax; and

• the accrued pension benefi t liability would

increase by approximately $225 million

as of December 31, 2010 resulting in an

after-tax decrease to shareholders’ equity

of approximately $145 million as of

December 31, 2010.

If the expected long-term return on domestic

qualifi ed pension plan assets decreased by 50 basis

points, annual pension costs for 2011 would

increase by approximately $10 million after-tax.

If the Company used the market value of assets to

measure pension costs as opposed to the market-

related value, annual pension cost for 2011 would

increase by approximately $15 million after-tax.

If the December 31, 2010 fair values of

domestic qualifi ed plan assets decreased by 10%,

the accrued pension benefi t liability would

increase by approximately $315 million as of

December 31, 2010 resulting in an after-tax

decrease to shareholders’ equity of approximately

$205 million.

An increase in these key assumptions would result

in impacts to annual pension costs, the accrued

pension liability and shareholders’ equity in an

opposite direction, but similar amounts.