Cigna 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

100

PART II

ITEM 8 Financial Statements and Supplementary Data

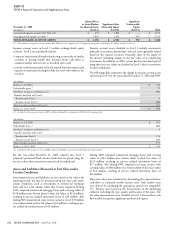

• e annual annuity election rate assumption refl ects experience that

diff ers by the company issuing the underlying variable annuity contracts

and depends on the annuitant’s age, the relative value of the guarantee

and whether a contractholder has had a previous opportunity to elect

the benefi t. Immediately after the expiration of the waiting period, the

assumed probability that an individual will annuitize their variable

annuity contract is up to 80%. For the second and subsequent annual

opportunities to elect the benefi t, the assumed probability of election is

up to 30%. Actual data is still emerging for the Company as well as the

industry and the estimates are based on this limited data.

• e nonperformance risk adjustment is incorporated by adding an

additional spread to the discount rate in the calculation of both

(1) the GMIB liability to refl ect a hypothetical market participant’s

view of the risk of the Company not fulfi lling its GMIB obligations,

and (2) the GMIB asset to refl ect a hypothetical market participant’s

view of the reinsurers’ credit risk, after considering collateral. e

estimated market-implied spread is company-specifi c for each

party involved to the extent that company-specifi c market data

is available and is based on industry averages for similarly rated

companies when company-specifi c data is not available. e spread

is impacted by the credit default swap spreads of the specifi c parent

companies, adjusted to refl ect subsidiaries’ credit ratings relative to

their parent company and any available collateral. e additional

spread over LIBOR incorporated into the discount rate ranged

from 5 to 110 basis points for the GMIB liability and from 10 to

85 basis points for the GMIB reinsurance asset for that portion of

the interest rate curve most relevant to these policies.

• e risk and profi t charge assumption is based on the Company’s

estimate of the capital and return on capital that would be required

by a hypothetical market participant.

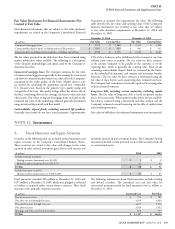

e Company regularly evaluates each of the assumptions used

in establishing these assets and liabilities by considering how a

hypothetical market participant would set assumptions at each

valuation date. Capital markets assumptions are expected to change at

each valuation date refl ecting currently observable market conditions.

Other assumptions may also change based on a hypothetical market

participant’s view of actual experience as it emerges over time or other

factors that impact the net liability. If the emergence of future experience

or future assumptions diff ers from the assumptions used in estimating

these assets and liabilities, the resulting impact could be material to the

Company’s consolidated results of operations, and in certain situations,

could be material to the Company’s fi nancial condition.

GMIB liabilities are reported in the Company’s Consolidated

Balance Sheets in Accounts payable, accrued expenses and other

liabilities. GMIB assets associated with these contracts represent

net receivables in connection with reinsurance that the Company

has purchased from two external reinsurers and are reported in the

Company’s Consolidated Balance Sheets in Other assets, including

other intangibles.

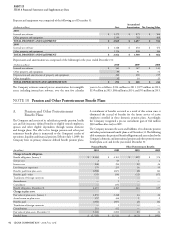

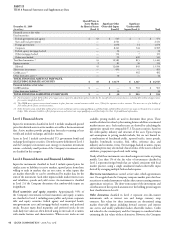

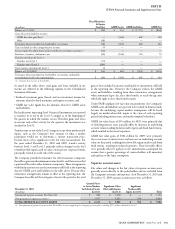

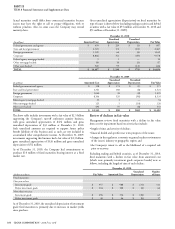

Changes in Level 3 Financial Assets and Financial

Liabilities Carried at Fair Value

e following tables summarize the changes in fi nancial assets

and fi nancial liabilities classifi ed in Level 3 for the years ended

December 31, 2010 and 2009. ese tables exclude separate account

assets as changes in fair values of these assets accrue directly to

policyholders. Gains and losses reported in this table may include

changes in fair value that are attributable to both observable and

unobservable inputs.

(In millions)

Fixed Maturities

&Equity

Securities GMIB Assets GMIB Liabilities GMIB Net

Balance at 1/1/2010 $ 845 $ 482 $ (903) $ (421)

Gains (losses) included in income:

GMIB fair value gain/(loss) — 57 (112) (55)

Other 27———

Total gains (losses) included in shareholders’ net income 27 57 (112) (55)

Gains included in other comprehensive income 10———

Gains required to adjust future policy benefi ts for settlement annuities (1) 34———

Purchases, issuances, settlements, net (74) (59) 112 53

Transfers into/(out of) Level 3:

Transfers into Level 3 155———

Transfers out of Level 3 (64)———

Total transfers into/(out of) Level 3 91———

Balance at 12/31/2010 $ 933 $ 480 $ (903) $ (423)

Total gains (losses) included in shareholders’ net income attributable

to instruments held at the reporting date $ 18 $ 57 $ (112) $ (55)

(1) Amounts do not accrue to shareholders.