Chevron 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2008 Annual Report 97

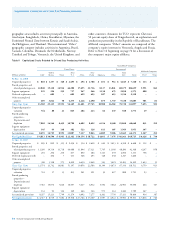

Consolidated Companies

United States International

Gulf of Total Asia- Total Affiliated Companies

Millions of dollars Calif. Mexico Other U.S. Africa Pacific Indonesia Other Int’l. Total TCO Other

Year Ended Dec. 31, 2006

Revenues from net

production

Sales $ 308 $ 1,845 $ 2,976 $ 5,129 $ 2,377 $ 4,938 $ 1,001 $ 2,814 $ 11,130 $ 16,259 $ 2,861 $ 598

Transfers 4,072 2,317 2,046 8,435 5,264 4,084 2,211 2,848 14,407 22,842 – –

Total 4,380 4,162 5,022 13,564 7,641 9,022 3,212 5,662 25,537 39,101 2,861 598

Production expenses

excluding taxes (889) (765) (1,057) (2,711) (640) (740) (728) (664) (2,772) (5,483) (202) (42)

Taxes other than on

income (84) (57) (442) (583) (57) (231) (1) (60) (349) (932) (28) (6)

Proved producing properties:

Depreciation and depletion (275) (1,096) (763) (2,134) (579) (1,475) (666) (703) (3,423) (5,557) (114) (33)

Accretion expense2 (11) (80) (39) (130) (26) (30) (23) (49) (128) (258) (1) –

Exploration expenses – (407) (24) (431) (296) (209) (110) (318) (933) (1,364) (25) –

Unproved properties

valuation (3) (73) (8) (84) (28) (15) (14) (27) (84) (168) – –

Other income (expense)3 1 (732) 254 (477) (435) (475) 50 385 (475) (952) 8 (50)

Results before

income taxes 3,119 952 2,943 7,014 5,580 5,847 1,720 4,226 17,373 24,387 2,499 467

Income tax expense (1,169) (357) (1,103) (2,629) (4,740) (3,224) (793) (2,151) (10,908) (13,537) (750) (174)

Results of Producing

Operations $ 1,950 $ 595 $ 1,840 $ 4,385 $ 840 $ 2,623 $ 927 $ 2,075 $ 6,465 $ 10,850 $ 1,749 $ 293

1 The value of owned production consumed in operations as fuel has been eliminated from revenues and production expenses, and the related volumes have been deducted from net

production in calculating the unit average sales price and production cost. This has no effect on the results of producing operations.

2 Represents accretion of ARO liability. Refer to Note 24, “Asset Retirement Obligations,” beginning on page 89.

3 Includes foreign currency gains and losses, gains and losses on property dispositions, and income from operating and technical service agreements.

Table III Results of Operations for Oil and

Gas Producing Activities1 – Continued