Chevron 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 Chevron Corporation 2008 Annual Report

Note 25

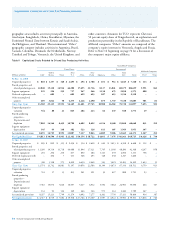

Other Financial Information

Net income in 2008 included gains of approximately $1,200

relating to the sale of nonstrategic properties. Of this amount,

approximately $1,000 related to upstream assets. Net income

in 2007 included gains of approximately $2,000 relating to the

sale of nonstrategic properties. Of this amount, approximately

$1,100 related to downstream assets and $680 related to the

sale of the company’s investment in Dynegy Inc.

Other financial information is as follows:

Year ended December 31

2008 2007 2006

Total financing interest and debt costs $ 256 $ 468 $ 608

Less: Capitalized interest 256 302 157

Interest and debt expense $ – $ 166 $ 451

Research and development expenses $ 835 $ 562 $ 468

Foreign currency effects* $ 862 $ (352) $ (219)

*

Includes $420, $18 and $15 in 2008, 2007 and 2006, respectively, for the com-

pany’s share of equity affiliates’ foreign currency effects.

The excess of replacement cost over the carrying value of

inventories for which the Last-In, First-Out (LIFO) method

is used was $9,368 and $6,958 at December 31, 2008 and

2007, respectively. Replacement cost is generally based on

average acquisition costs for the year. LIFO profits of $210,

$113 and $82 were included in net income for the years

2008, 2007 and 2006, respectively.

Note 26

Assets Held for Sale

At December 31, 2008, the company classified $252 of net

properties, plant and equipment as “Assets held for sale”

on the Consolidated Balance Sheet. Assets in this category

related to groups of service stations, aviation facilities, lubri-

cants blending plants, and commercial and industrial fuels

business. These assets are anticipated to be sold in 2009.

Note 27

Earnings Per Share

Basic earnings per share (EPS) is based upon net income

less preferred stock dividend requirements and includes

the effects of deferrals of salary and other compensation

awards that are invested in Chevron stock units by certain

officers and employees of the company and the company’s

share of stock transactions of affiliates, which, under the

applicable accounting rules, may be recorded directly to the

company’s retained earnings instead of net income. Diluted

EPS includes the effects of these items as well as the dilu-

tive effects of outstanding stock options awarded under the

company’s stock option programs (refer to Note 21, “Stock

Options and Other Share-Based Compensation” beginning

on page 80). The table below sets forth the computation

of basic and diluted EPS:

Year ended December 31

2008 2007 2006

Basic EPS Calculation

Income from operations $ 23,931 $ 18,688 $ 17,138

Add: Dividend equivalents paid on stock units – – 1

Net income available to common stockholders – Basic $ 23,931 $ 18,688 $ 17,139

Weighted-average number of common shares outstanding 2,037 2,117 2,185

Add: Deferred awards held as stock units 1 1 1

Total weighted-average number of common shares outstanding 2,038 2,118 2,186

Per share of common stock

Net income – Basic $ 11.74 $ 8.83 $ 7.84

Diluted EPS Calculation

Income from operations $ 23,931 $ 18,688 $ 17,138

Add: Dividend equivalents paid on stock units – – 1

Add: Dilutive effects of employee stock-based awards – – –

Net income available to common stockholders – Diluted $ 23,931 $ 18,688 $ 17,139

Weighted-average number of common shares outstanding 2,037 2,117 2,185

Add: Deferred awards held as stock units 1 1 1

Add: Dilutive effect of employee stock-based awards 12 14 11

Total weighted-average number of common shares outstanding 2,050 2,132 2,197

Per share of common stock

Net income – Diluted $ 11.67 $ 8.77 $ 7.80

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts