Chevron 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 Chevron Corporation 2008 Annual Report

Net actuarial losses recorded in “Accumulated other com-

prehensive loss” at December 31, 2008, for the company’s U.S.

pension, international pension and OPEB plans are being

amortized on a straight-line basis over approximately 10, 13

and 10 years, respectively. These amortization periods repre-

sent the estimated average remaining service of employees

expected to receive benefits under the plans. These losses are

amortized to the extent they exceed 10 percent of the higher of

the projected benefit obligation or market-related value of

plan assets. The amount subject to amortization is deter-

mined on a plan-by-plan basis. During 2009, the company

estimates actuarial losses of $298, $103 and $28 will be amor-

tized from “Accumulated other comprehensive loss” for U.S.

pension, international pension and OPEB plans, respectively. In

Note 22 Employee Benefit Plans – Continued

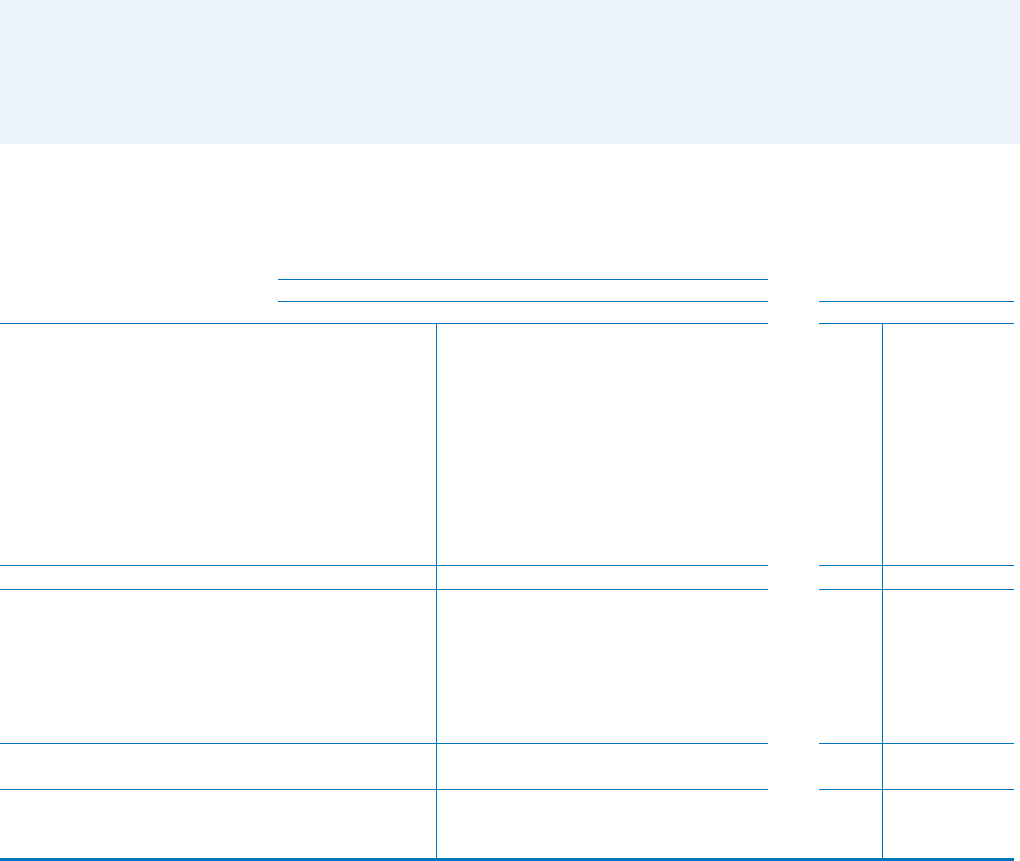

The components of net periodic benefit cost for 2008, 2007 and 2006 and amounts recognized in other comprehensive income

for 2008 and 2007 are shown in the table below. For 2008 and 2007, changes in pension plan assets and benefit obligations were

recognized as changes in other comprehensive income.

Pension Benefits

2008 2007 2006 Other Benefits

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2008 2007 2006

Net Periodic Benefit Cost

Service cost $ 250 $ 132 $ 260 $ 125 $ 234 $ 98 $ 44 $ 49 $ 35

Interest cost 499 292 483 255 468 214 178 184 181

Expected return on plan assets (593) (273) (578) (266) (550) (227) – – –

Amortization of transitional assets – – – – – 1 – – –

Amortization of prior-service

(credits) costs (7) 24 46 17 46 14 (81) (81) (86)

Recognized actuarial losses 60 77 128 82 149 69 38 81 97

Settlement losses 306 2 65 – 70 – – – –

Curtailment losses – – – 3 – – – – –

Special termination benefit recognition – 1 – – – – – – –

Net periodic benefit cost 515 255 404 216 417 169 179 233 227

Changes Recognized in Other

Comprehensive Income

Net actuarial loss (gain) during period 2,624 646 (160) 31 – – (42) (401) –

Amortization of actuarial loss (366) (79) (193) (82) – – (38) (81) –

Prior service cost (credit) during period – 32 (301) 97 – – – – –

Amortization of prior-service

credits (costs) 7 (24) (46) (20) – – 81 81 –

Total changes recognized in

other comprehensive income 2,265 575 (700) 26 – – 1 (401) –

Recognized in Net Periodic

Benefit Cost and Other

Comprehensive Income $ 2,780 $ 830 $ (296) $ 242 $ 417 $ 169 $ 180 $ ( 1 6 8 ) $ 227

addition, the company estimates an additional $201 will be rec-

ognized from “Accumulated other comprehensive loss” during

2009 related to lump-sum settlement costs from U.S. pension

plans.

The weighted-average amortization period for recognizing

prior service costs (credits) recorded in “Accumulated other

comprehensive loss” at December 31, 2008, was approximately

nine and 13 years for U.S. and international pension plans,

respectively, and eight years for other postretirement benefit

plans. During 2009, the company estimates prior service

(credits) costs of $(7), $25 and $(81) will be amortized from

“Accumulated other comprehensive loss” for U.S. pension,

international pension and OPEB plans, respectively.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts