Chevron 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2008 Annual Report 89

It is likely that the company will continue to incur

additional liabilities, beyond those recorded, for environ-

mental remediation relating to past operations. These

future costs are not fully determinable due to such factors

as the unknown magnitude of possible contamination, the

unknown timing and extent of the corrective actions that

may be required, the determination of the company’s liability

in proportion to other responsible parties, and the extent to

which such costs are recoverable from third parties.

Refer to Note 24 below for a discussion of the company’s

Asset Retirement Obligations.

Equity Redetermination For oil and gas producing operations,

ownership agreements may provide for periodic reassess-

ments of equity interests in estimated crude oil and natural

gas reserves. These activities, individually or together, may

result in gains or losses that could be material to earnings in

any given period. One such equity redetermination process

has been under way since 1996 for Chevron’s interests in four

producing zones at the Naval Petroleum Reserve at Elk Hills,

California, for the time when the remaining interests in these

zones were owned by the U.S. Department of Energy. A wide

range remains for a possible net settlement amount for the

four zones. For this range of settlement, Chevron estimates

its maximum possible net before-tax liability at approxi-

mately $200, and the possible maximum net amount that

could be owed to Chevron is estimated at about $150. The

timing of the settlement and the exact amount within this

range of estimates are uncertain.

Other Contingencies Chevron receives claims from and sub-

mits claims to customers; trading partners; U.S. federal, state

and local regulatory bodies; governments; contractors; insur-

ers; and suppliers. The amounts of these claims, individually

and in the aggregate, may be significant and take lengthy

periods to resolve.

The company and its affiliates also continue to review

and analyze their operations and may close, abandon, sell,

exchange, acquire or restructure assets to achieve operational

or strategic benefits and to improve competitiveness and prof-

itability. These activities, individually or together, may result

in gains or losses in future periods.

Note 24

Asset Retirement Obligations

The company accounts for asset retirement obligations

(ARO) in accordance with Financial Accounting Standards

Board (FASB) Statement No. 143, Accounting for Asset Retire-

ment Obligations (FAS 143) and FASB Interpretation No. 47,

Accounting for Conditional Asset Retirement Obligations – An

Interpretation of FASB Statement No. 143 (FIN 47). FAS 143

applies to the fair value of a liability for an ARO that is

recorded when there is a legal obligation associated with the

retirement of a tangible long-lived asset and the liability can

be reasonably estimated. Obligations associated with the

retirement of these assets require recognition in certain cir-

cumstances: (1) the present value of a liability and offsetting

asset for an ARO, (2) the subsequent accretion of that liabil-

ity and depreciation of the asset, and (3) the periodic review

of the ARO liability estimates and discount rates. FIN 47

clarifies that the phrase “conditional asset retirement obliga-

tion,” as used in FAS 143, refers to a legal obligation to

perform asset retirement activity for which the timing and/or

method of settlement are conditional on a future event that

may or may not be within the control of the company. The

obligation to perform the asset retirement activity is uncondi-

tional even though uncertainty exists about the timing and/

or method of settlement. Uncertainty about the timing and/

or method of settlement of a conditional ARO should be fac-

tored into the measurement of the liability when sufficient

information exists. FAS 143 acknowledges that in some cases,

sufficient information may not be available to reasonably esti-

mate the fair value of an ARO. FIN 47 also clarifies when an

entity would have sufficient information to reasonably esti-

mate the fair value of an ARO.

FAS 143 and FIN 47 primarily affect the company’s

accounting for crude oil and natural gas producing assets.

No significant AROs associated with any legal obligations to

retire refining, marketing and transportation (downstream)

and chemical long-lived assets have been recognized, as inde-

terminate settlement dates for the asset retirements prevent

estimation of the fair value of the associated ARO. The com-

pany performs periodic reviews of its downstream and chemical

long-lived assets for any changes in facts and circumstances

that might require recognition of a retirement obligation.

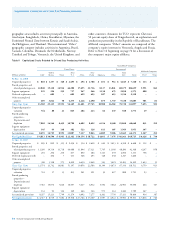

The following table indicates the changes to the com-

pany’s before-tax asset retirement obligations in 2008, 2007

and 2006:

2008 2007 2006

Balance at January 1 $ 8,253 $ 5,773 $ 4,304

Liabilities incurred 308 178 153

Liabilities settled (973) (818) (387)

Accretion expense 430 399* 275

Revisions in estimated cash flows 1,377 2,721 1,428

Balance at December 31 $ 9,395 $ 8,253 $ 5,773

*

Includes $175 for revision to the ARO liability retained on properties that had

been sold.

In the table above, the amounts associated with “Revisions

in estimated cash flows” reflect increasing costs to abandon

onshore and offshore wells, equipment and facilities, includ-

ing an aggregate of $1,804 for 2006 through 2008 for the

estimated costs to dismantle and abandon wells and facilities

damaged by hurricanes in the U.S. Gulf of Mexico in 2005

and 2008. The long-term portion of the $9,395 balance at the

end of 2008 was $8,588.

Note 23 Other Contingencies and Commitments – Continued