Chevron 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2008 Annual Report 67

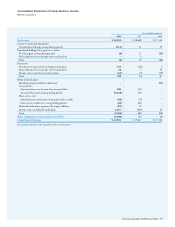

During 2008, Chevron implemented legal reorganiza-

tions in which certain Chevron subsidiaries transferred assets

to or under CUSA. The summarized financial information

for CUSA and its consolidated subsidiaries presented in the

table below gives retroactive effect to the reorganizations as if

they had occurred on January 1, 2006. However, the financial

information in the following table may not reflect the financial

position and operating results in the periods presented if the

reorganization actually had occurred on that date.

Year ended December 31

2008 2007 2006

Sales and other operating

revenues $ 195,593 $ 153,574 $ 145,774

Total costs and other deductions 185,788 147,510 137,765

Net income 7,237 5,203 5,668

At December 31

2008 2007

Current assets $ 32,760 $ 32,801

Other assets 31,806 27,400

Current liabilities 14,322 20,050

Other liabilities 14,805 11,447

Net equity 35,439 28,704

Memo: Total debt $ 6,813 $ 4,433

Note 5

Summarized Financial Data Chevron Transport Corporation Ltd.

Chevron Transport Corporation Ltd. (CTC), incorporated in

Bermuda, is an indirect, wholly owned subsidiary of Chevron

Corporation. CTC is the principal operator of Chevron’s inter-

national tanker fleet and is engaged in the marine transportation

of crude oil and refined petroleum products. Most of CTC’s

shipping revenue is derived from providing transportation serv-

ices to other Chevron companies. Chevron Corporation has

fully and unconditionally guaranteed this subsidiary’s obliga-

tions in connection with certain debt securities issued by a third

party. Summarized financial information for CTC and its con-

solidated subsidiaries is presented in the following table:

Year ended December 31

2008 2007 2006

Sales and other operating revenues $ 1,022 $ 667 $ 692

Total costs and other deductions 947 713 602

Net income 120 (39) 119

At December 31

2008 2007

Current assets $ 482 $ 335

Other assets 172 337

Current liabilities 98 107

Other liabilities 88 188

Net equity 468 377

There were no restrictions on CTC’s ability to pay divi-

dends or make loans or advances at December 31, 2008.

Note 6

Summarized Financial Data Tengizchevroil LLP.

Chevron has a 50 percent equity ownership interest in

Tengizchevroil LLP (TCO). Refer to Note 12 on page 72

for a discussion of TCO operations.

Summarized financial information for 100 percent of

TCO is presented in the table below:

Year ended December 31

2008 2007 2006

Sales and other operating revenues $ 14,329 $ 8,919 $ 7,654

Costs and other deductions 5,621 3,387 2,967

Net income 6,134 3,952 3,315

At December 31

2008 2007

Current assets $ 2,740 $ 2,784

Other assets 12,240 11,446

Current liabilities 1,867 1,534

Other liabilities 4,759 4,927

Net equity 8,354 7,769

Note 7

Financial and Derivative Instruments

Derivative Commodity Instruments Chevron is exposed to

market risks related to price volatility of crude oil, refined prod-

ucts, natural gas, natural gas liquids, liquefied natural gas and

refinery feedstocks.

The company uses derivative commodity instruments to

manage these exposures on a portion of its activity, including

firm commitments and anticipated transactions for the pur-

chase, sale and storage of crude oil, refined products, natural

gas, natural gas liquids and feedstock for company refineries.

From time to time, the company also uses derivative commod-

ity instruments for limited trading purposes.

The company uses Inter national Swaps and Derivatives

Association agreements to govern derivative contracts with cer-

tain counterparties to mitigate credit risk. Depending on the

nature of the derivative transactions, bilateral collateral arrange-

ments may also be required. When the company is engaged in

more than one outstanding derivative transaction with the same

counterparty and also has a legally enforceable netting agree-

ment with that counterparty, the net mark-to-market exposure

represents the netting of the positive and negative exposures

with that counterparty and is a reasonable measure of the

company’s credit risk exposure. The company also uses other

netting agreements with certain counterparties with which it

conducts significant transactions to mitigate credit risk.

The fair values of the outstanding contracts are reported

on the Consolidated Balance Sheet as “Accounts and notes

receivable,” “Accounts payable,” “Long-term receivables –

net” and “Deferred credits and other noncurrent obligations.”

Gains and losses on the company’s risk management activities

Note 4 Summarized Financial Data – Chevron U.S.A. Inc. – Continued