Chevron 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2008 Annual Report 99

During the year, the RAC is represented in meetings

with each of the company’s upstream business units to review

and discuss reserve changes recommended by the various

asset teams. Major changes are also reviewed with the com-

pany’s Strategy and Planning Committee and the Executive

Committee, whose members include the Chief Executive

Officer and the Chief Financial Officer. The company’s

annual reserve activity is also reviewed with the Board of

Directors. If major changes to reserves were to occur between

the annual reviews, those matters would also be discussed

with the Board.

RAC subteams also conduct in-depth reviews during

the year of many of the fields that have the largest proved

reserves quantities. These reviews include an examination of

the proved-reserve records and documentation of their align-

ment with the Corporate Reserves Manual.

Modernization of Oil and Gas Reporting In December

2008, the SEC issued its final rule, Modernization of Oil and

Gas Reporting (Release Nos. 33-8995; 34-59192; FR-78).

The disclosure requirements under the final rule will become

effective for the company in its Form 10-K filing for the year

ending December 31, 2009. The final rule changes a number

of oil and gas reserve estimation and disclosure requirements

under SEC Regulations S-K and S-X.

Among the principal changes in the final rule are

requirements to use a price based on a 12-month average for

reserve estimation and disclosure instead of a single end-of-

year price; expanding the definition of oil and gas producing

activities to include nontraditional sources such as bitumen

extracted from oil sands; permitting the use of new reli-

able technologies to establish reasonable certainty of proved

reserves; allowing optional disclosure of probable and pos-

sible reserves; modifying the definition of geographic area

for disclosure of reserve estimates and production; amending

disclosures of proved reserve quantities to include separate

disclosures of synthetic oil and gas; expanding proved,

undeveloped reserve disclosures (PUDs), including discus-

sion of PUDs five years old or more; and disclosure of the

qualifications of the chief technical person who oversees the

company’s overall reserves estimation process.

Reserve Quantities At December 31, 2008, oil-equivalent

reserves for the company’s consolidated operations were 7.9

billion barrels. (Refer to the term “Reserves” on page 32

for the definition of oil-equivalent reserves.) Approximately

25 percent of the total reserves were in the United States.

For the company’s interests in equity affiliates, oil-equivalent

reserves were 3.3 billion barrels, 82 percent of which were

associated with the company’s 50 percent ownership in TCO.

Aside from the Tengiz Field in the TCO affiliate, no

single property accounted for more than 5 percent of the

company’s total oil-equivalent proved reserves. About 20 other

individual properties in the company’s portfolio of assets

each contained between 1 percent and 5 percent of the com-

pany’s oil-equivalent proved reserves, which in the aggregate

accounted for approximately 40 percent of the company’s

total proved reserves. These properties were geographically

dispersed, located in the United States, South America, west-

ern Africa, the Middle East and the Asia-Pacific region.

In the United States, total oil-equivalent reserves at

year-end 2008 were 2.0 billion barrels. Of this amount, 43

percent, 22 percent and 35 percent were located in California,

the Gulf of Mexico and other U.S. areas, respectively.

In California, liquids reserves represented 94 percent of

the total, with most classified as heavy oil. Because of heavy

oil’s high viscosity and the need to employ enhanced recovery

methods, the producing operations are capital intensive in

nature. Most of the company’s heavy-oil fields in California

employ a continuous steamflooding process.

In the Gulf of Mexico region, liquids represented

approximately 66 percent of total oil-equivalent reserves.

Production operations are mostly offshore and, as a result, are

also capital intensive. Costs include investments in wells, pro-

duction platforms and other facilities, such as gathering lines

and storage facilities.

In other U.S. areas, the reserves were split about equally

between liquids and natural gas. For production of crude oil,

some fields utilize enhanced recovery methods, including

water-flood and CO2 injection.

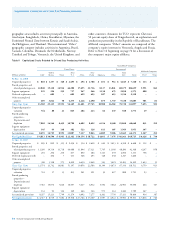

The pattern of net reserve changes shown in the follow-

ing tables, for the three years ending December 31, 2008,

is not necessarily indicative of future trends. Apart from

acquisitions, the company’s ability to add proved reserves is

affected by, among other things, events and circumstances

that are outside the company’s control, such as delays in gov-

ernment permitting, partner approvals of development plans,

declines in oil and gas prices, OPEC constraints, geopolitical

uncertainties and civil unrest.

The upward revision in Thailand reflected additional

drilling and development activity during the year. These

upward revisions were partially offset by reductions in reser-

voir performance in Nigeria and the United Kingdom, which

decreased reserves by 43 million barrels and by 32 million

barrels, respectively. Most of the upward revision for affiliated

companies was related to a 60 million-barrel increase in TCO

as a result of improved reservoir performance.

In 2007, net revisions decreased reserves by 146 million

barrels for worldwide consolidated companies and increased

reserves by 103 million barrels for equity affiliates. For con-

solidated companies, the largest downward net revisions were

89 million barrels in Africa and 66 million barrels in Indonesia.

The company’s estimated net proved oil and natural gas

reserves and changes thereto for the years 2006, 2007 and

2008 are shown in the tables on pages 100 and 102.

Table V Reserve Quantity Information – Continued