Chevron 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2008 Annual Report 69

company uses to value an asset or a liability. The three levels

of the fair-value hierarchy are described as follows:

Level 1: Quoted prices (unadjusted) in active markets

for identical assets and liabilities. For the company,

Level 1 inputs include exchange-traded futures con-

tracts for which the parties are willing to transact at

the exchange-quoted price and marketable securities

that are actively traded.

Level 2: Inputs other than Level 1 that are observable,

either directly or indirectly. For the company, Level 2

inputs include quoted prices for similar assets or liabili-

ties, prices obtained through third-party broker quotes,

and prices that can be corroborated with other observ-

able inputs for substantially the complete term of

a contract.

Level 3: Unobservable inputs. The company does not

use Level 3 inputs for any of its recurring fair-value

measurements. Beginning January 1, 2009, Level 3

inputs may be required for the determination of fair

value associated with certain nonrecurring measure-

ments of nonfinancial assets and liabilities.

The fair-value hierarchy for assets and liabilities mea-

sured at fair value at December 31, 2008, is as follows:

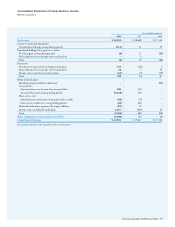

Assets and Liabilities Measured at Fair Value on a Recurring Basis

Prices in Active

Markets for Other

Identical Observable Unobservable

At December 31 Assets/Liabilities Inputs Inputs

2008 (Level 1) (Level 2) (Level 3)

Marketable Securities $ 213 $ 213 $ – $ –

Derivatives 805 529 276 –

Total Assets at Fair Value $1,018 $ 742 $ 276 $ –

Derivatives $ 516 $ 98 $ 418 $ –

Total Liabilities at Fair Value $ 516 $ 98 $ 418 $ –

Marketable securities The company calculates fair value for

its marketable securities based on quoted market prices for

identical assets and liabilities.

Derivatives The company records its derivative instru-

ments – other than any commodity derivative contracts that

are designated as normal purchase and normal sale – on the

Consolidated Balance Sheet at fair value, with virtually all the

offsetting amount to income. For derivatives with identical

or similar provisions as contracts that are publicly traded on a

regular basis, the company uses the market values of the pub-

licly traded instruments as an input for fair-value calculations.

The company’s derivative instruments principally

include crude oil, natural gas and refined-product futures,

swaps, options and forward contracts, as well as interest-rate

swaps and foreign currency forward contracts. Derivatives

classified as Level 1 include futures, swaps and options con-

tracts traded in active markets such as the NYMEX (New

York Mercantile Exchange).

Derivatives classified as Level 2 include swaps (includ-

ing interest rate), options, and forward (including foreign

currency) contracts principally with financial institutions

and other oil and gas companies, the fair values for which

are obtained from third-party broker quotes, industry pric-

ing services and exchanges. The company obtains multiple

sources of pricing information for the Level 2 instruments.

Since this pricing information is generated from observable

market data, it has historically been very consistent. The

company does not materially adjust this information. The

company incorporates internal review, evaluation and assess-

ment procedures, including a comparison of Level 2 fair

values derived from the company’s internally developed for-

ward curves (on a sample basis) with the pricing information

to document reasonable, logical and supportable fair-value

determinations and proper level of classification.

Note 9

Operating Segments and Geographic Data

Although each subsidiary of Chevron is responsible for its

own affairs, Chevron Corporation manages its investments

in these subsidiaries and their affiliates. For this purpose,

the investments are grouped as follows: upstream – explora-

tion and production; downstream – refining, marketing and

transportation; chemicals; and all other. The first three of

these groupings represent the company’s “reportable segments”

and “operating segments” as defined in Financial Accounting

Standards Board (FASB) Statement No. 131, Disclosures About

Segments of an Enterprise and Related Information (FAS 131).

The segments are separately managed for investment

purposes under a structure that includes “segment managers”

who report to the company’s “chief operating decision maker”

(CODM) (terms as defined in FAS 131). The CODM is

the company’s Executive Committee, a committee of senior

officers that includes the Chief Executive Officer and that, in

turn, reports to the Board of Directors of Chevron Corporation.

The operating segments represent components of the

company as described in FAS 131 terms that engage in activi-

ties (a) from which revenues are earned and expenses are

incurred; (b) whose operating results are regularly reviewed

by the CODM, which makes decisions about resources to be

allocated to the segments and to assess their performance;

and (c) for which discrete financial information is available.

Segment managers for the reportable segments are

accountable directly to and maintain regular contact with the

company’s CODM to discuss the segment’s operating activities

and financial performance. The CODM approves annual

capital and exploratory budgets at the reportable segment level,

as well as reviews capital and exploratory funding for major

Note 8 Fair Value Measurements – Continued