Activision 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

Method and Assumptions on Valuation of Stock Options

Our employee stock options have features that differentiate them from exchange- traded

options. These features include lack of transferability, early exercise, vesting restrictions, pre- and

post-vesting termination provisions, blackout dates, and time-varying inputs. In addition, some of

the options have non-traditional features, such as accelerated vesting upon the satisfaction of

certain performance conditions that must be reflected in the valuation. A binomial-lattice model

was selected because it is better able to explicitly address these features than closed-form models

such as the Black- Scholes model, and is able to reflect expected future changes in model inputs,

including changes in volatility, during the option’s contractual term.

Consistent with SFAS No. 123R, we have attempted to reflect expected future changes in

model inputs during the option’s contractual term. The inputs required by our binomial-lattice

model include expected volatility, risk-free interest rate, risk-adjusted stock return, dividend yield,

contractual term, and vesting schedule, as well as measures of employees’ forfeiture, exercise, and

post-vesting termination behavior. Statistical methods were used to estimate employee rank-

specific termination rates. These termination rates, in turn, were used to model the number of

options that are expected to vest and post-vesting termination behavior. Employee rank-specific

estimates of Expected Time-To-Exercise (“ETTE”) were used to reflect employee exercise

behavior. ETTE was estimated by using statistical procedures to first estimate the conditional

probability of exercise occurring during each time period, conditional on the option surviving to

that time period and then using those probabilities to estimate ETTE. The model was calibrated by

adjusting parameters controlling exercise and post-vesting termination behavior so that the

measures output by the model matched values of these measures that were estimated from

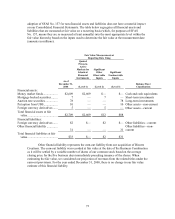

historical data. We determined the weighted-average estimated value of employee stock options

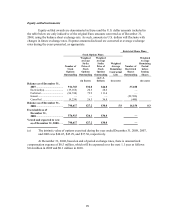

granted during the year using the binomial- lattice model with the following weighted-average

assumptions:

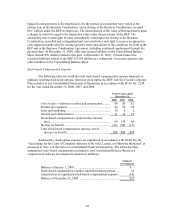

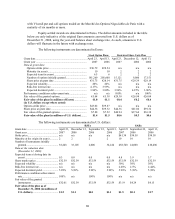

Employee

and

director

options

For the year

ended

December 31,

2008

Expected life (in years) ..................................................................................................................... 5.28

Risk free interest rate......................................................................................................................... 3.98%

Volatility ........................................................................................................................................... 53.88%

Dividend yield................................................................................................................................... —

Weighted-average fair value at grant date......................................................................................... $5.92

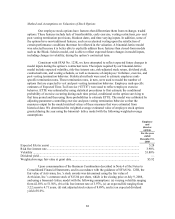

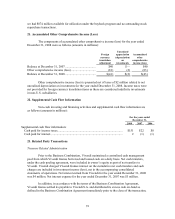

Upon consummation of the Business Combination described in Note 4 of the Notes to

Consolidated Financial Statements, and in accordance with the guidance of SFAS No. 123R, the

fair value of Activision, Inc.’s stock awards was determined using the fair value of

Activision, Inc.’s common stock of $15.04 per share, which is the closing price at July 9, 2008,

and using a binomial- lattice model with the following assumptions: (a) varying volatility ranging

from 42.38% to 51.50%, (b) a risk free interest rate of 3.97%, (c) an expected life ranging from

3.22 years to 4.71 years, (d) risk adjusted stock return of 8.89%, and (e) an expected dividend

yield of 0.0%.