Activision 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

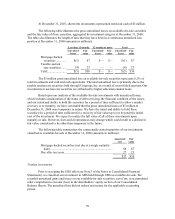

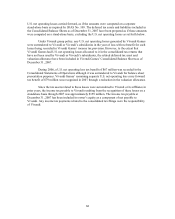

In connection with our acceptance of the UBS offer in November 2008, resulting in our

right to require UBS to purchase our ARS at par value beginning on June 30, 2010, we transferred

our investments in ARS held through UBS from available-for-sale to trading securities in

accordance with Statement of Financial Accounting Standard No. 115, “Accounting for Certain

Investments in Debt and Equity Securities” (“SFAS 115”). The transfer to trading securities

reflects management’s intent to exercise the Rights during the period between June 30, 2010 and

July 3, 2012, which results in the securities being held for the purpose of selling them in the near

future. Prior to our agreement with UBS, our intent was to hold the ARS until the market

recovered. At the time of transfer, the unrealized loss on our ARS was $5 million. This unrealized

loss was included in accumulated other comprehensive income (loss). Upon transfer to trading

securities, we immediately recognized in investment income, net, the $5 million unrealized loss

not previously recognized in earnings. Subsequently, we recognized an additional decline in fair

value of $2 million for a total unrealized loss of $7 million, included in investment income, net, in

the Consolidated Statements of Operations for the year ended December 31, 2008. The fair value

of the ARS held through UBS totaled $55 million at December 31, 2008.

We continue to monitor the ARS market and consider its impact (if any) on the fair value

of our investments. If the market conditions deteriorate further, we may be required to record

additional unrealized losses in earnings, which may be offset by corresponding increases in value

of the UBS offer. (See Notes 3 and 5 of the Notes to Consolidated Financial Statements)

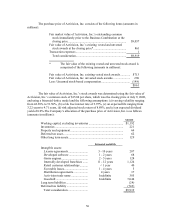

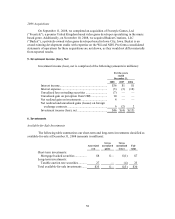

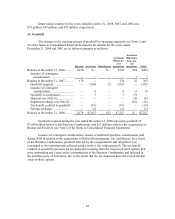

7. Software Development Costs and Intellectual Property Licenses

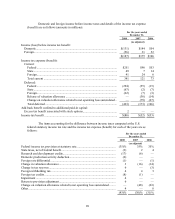

The following table presents the amortization and write-off of capitalized software

development costs and intellectual property licenses (amounts in millions):

For the years ended

December 31,

2008 2007 2006

(as adjusted)

Amortization of capitalized software development and intellectual

property licenses..................................................................................................... $90 $10 $8

Write-off and impairments ......................................................................................... 89 7 19

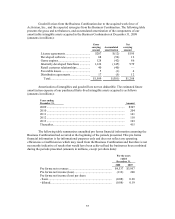

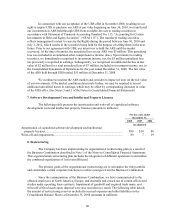

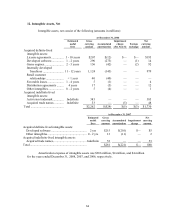

8. Restructuring

The Company has been implementing its organizational restructuring plan as a result of

the Business Combination described in Note 1 of the Notes to Consolidated Financial Statements.

This organizational restructuring plan includes the integration of different operations to streamline

the combined organization of Activision Blizzard.

The primary goals of the organizational restructuring are to rationalize the title portfolio

and consolidate certain corporate functions to realize synergies from the Business Combination.

Since the consummation of the Business Combination, we have communicated to the

affected employees in North America, Europe, and Australia and ceased use of certain offices and

studios under operating lease contracts. Impairment of goodwill and acquired trade name, and

write-off of fixed assets upon disposal were also recorded as a result. The following table details

the amount of restructuring reserves included in accrued expenses and other liabilities in the

Consolidated Balance Sheets at December 31, 2008 (amounts in millions):