Activision 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 28

adoption is prohibited. The adoption of FSP FAS 142-3 did not have a material impact on our

Consolidated Financial Statements.

Inflation

Our management currently believes that inflation has not had a material impact on

continuing operations.

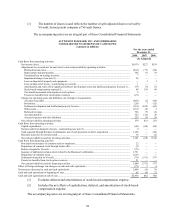

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk is the potential loss arising from fluctuations in market rates and prices. Our

market risk exposures primarily include fluctuations in interest rates, currency exchange rates, and

market prices. Our views on market risk are not necessarily indicative of actual results that may

occur and do not represent the maximum possible gains and losses that may occur, since actual

gains and losses will differ from those estimated, based upon actual fluctuations in interest rates,

currency exchange rates, market prices, and the timing of transactions.

Interest Rate Risk

Our exposure to market rate risk for changes in interest rates relates primarily to our

investment portfolio. We do not use derivative financial instruments to manage interest rate risk in

our investment portfolio. Our investment portfolio consists primarily of debt instruments with high

credit quality and relatively short average maturities and money market funds that invest in such

securities. Because short-term securities mature relatively quickly and must be reinvested at the

then current market rates, interest income on a portfolio consisting of cash, cash equivalents, or

short-term securities is more subject to market fluctuations than a portfolio of longer term

securities. Conversely, the fair value of such a portfolio is less sensitive to market fluctuations

than a portfolio of longer term securities. At December 31, 2008, our cash and cash equivalents,

and short-term investments included money market funds and mortgage-backed securities of

$2,609 million and $7 million, respectively. We have $78 million in auction rate securities at fair

value, which are classified as long-term investments, at December 31, 2008. Most of our

investment portfolio is invested in short-term or variable rate securities. Accordingly, we believe

that a sharp change in interest rates would not have a material effect on our short-term investment

portfolio.

Currency Exchange Rate Risk

We transact business in many different foreign currencies and may be exposed to

financial market risk resulting from fluctuations in foreign currency exchange rates. Currency

volatility is monitored frequently throughout the year. To mitigate our risk from foreign currency

fluctuations we enter into currency forward contracts with Vivendi, generally with maturities of

twelve months or less. . We expect to continue to use economic hedge programs in the future and

may use, in addition to currency forward contracts, derivative financial instruments such as

currency options to reduce financial market risks if it is determined that such hedging activities are

appropriate to reduce risk. We do not hold or purchase any foreign currency contracts for trading

or speculative purposes. The following procedures are designed to prohibit speculative

transactions:

• Vivendi is the counterparty for foreign currency transactions within Activision

Blizzard, unless specific regulatory, operational, or other considerations require

otherwise; and