Activision 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

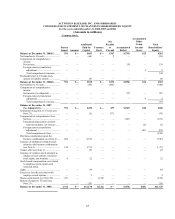

(1) The number of shares issued reflects the number of split adjusted shares received by

Vivendi, former parent company of Vivendi Games.

The accompanying notes are an integral part of these Consolidated Financial Statements.

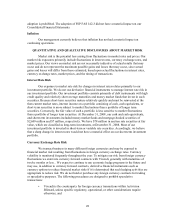

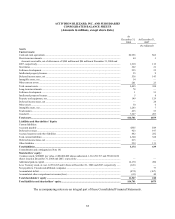

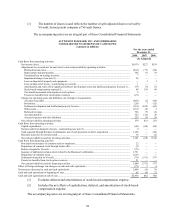

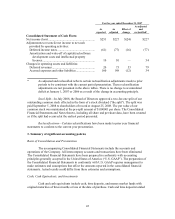

ACTIVISION BLIZZARD, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in millions)

For the years ended

December 31,

2008 2007 2006

(As Adjusted)

Cash flows from operating activities:

Net income (loss)........................................................................................................................................................ $(107) $227 $139

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Deferred income taxes........................................................................................................................................... (432) (77) (38)

Depreciation and amortization.............................................................................................................................. 385 63 39

Unrealized loss on trading securities .................................................................................................................... 7 — —

Impairment charges (see note 8) ........................................................................................................................... 26 — —

Loss on disposal of property and equipment ........................................................................................................ — 1 1

Loss on disposal of assets—restructuring (see note 8)......................................................................................... 1 — —

Amortization and write-off of capitalized software development costs and intellectual property licenses(1).... 176 54 81

Stock-based compensation expense(2) ................................................................................................................. 89 138 48

Tax benefit associated with employee stock options............................................................................................ 2 — —

Excess tax benefits from stock option exercises................................................................................................... (21) — —

Changes in operating assets and liabilities, net of impact of acquisitions:

Accounts receivable .............................................................................................................................................. (664) 25 (30)

Inventories............................................................................................................................................................. (20) 7 (12)

Software development and intellectual property licenses .................................................................................... (181) (102) (85)

Other assets............................................................................................................................................................ (163) (6) 2

Deferred revenues ................................................................................................................................................. 726 79 26

Accounts payable .................................................................................................................................................. 322 (12) 26

Accrued expenses and other liabilities.................................................................................................................. 233 34 36

Net cash provided by operating activities.................................................................................................................. 379 431 233

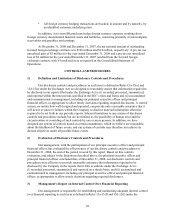

Cash flows from investing activities:

Capital expenditures................................................................................................................................................... (46) (68) (96)

Net proceeds from disposal of assets—restructuring (see note 8)............................................................................. 9 — —

Cash acquired through Business Combination, net of cash payments to effect acquisitions ................................... 1,120 — (26)

Decrease (increase) in restricted cash........................................................................................................................ 18 — (2)

Net cash provided by (used in) investing activities................................................................................................... 1,101 (68) (124)

Cash flows from financing activities:

Proceeds from issuance of common stock to employees........................................................................................... 22 — —

Repurchase of common stock through tender offer................................................................................................... (2) — —

Return of capital to Vivendi....................................................................................................................................... (79) — —

Issuance of additional common stock related to the Business Combination............................................................. 1,731 — —

Repurchase of common stock .................................................................................................................................... (126) — —

Settlement of payable to Vivendi............................................................................................................................... (79) (371) (77)

Excess tax benefits from stock option exercises........................................................................................................ 21 — —

Net cash provided by (used in) financing activities................................................................................................... 1,488 (371) (77)

Effect of foreign exchange rate changes on cash and cash equivalents ......................................................................... (72) 2 4

Net increase (decrease) in cash and cash equivalents..................................................................................................... 2,896 (6) 36

Cash and cash equivalents at beginning of year ............................................................................................................. 62 68 32

Cash and cash equivalents at end of year........................................................................................................................ $2,958 $62 $68

(1) Excludes deferral and amortizations of stock-based compensation expense.

(2) Includes the net effects of capitalization, deferral, and amortization of stock-based

compensation expense.

The accompanying notes are an integral part of these Consolidated Financial Statements.