Activision 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 94

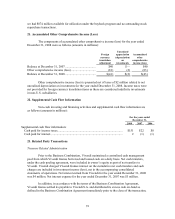

respect to the accounting for the non-refundable portion of a payment made by a research and

development entity for future research and development activities. Under this conclusion, an entity

is required to defer and capitalize non-refundable advance payments made for research and

development activities until the related goods are delivered or the related services are performed.

EITF 07-03 is effective for interim or annual reporting periods in fiscal years beginning after

December 15, 2007 and requires prospective application for new contracts entered into after the

effective date. The adoption of EITF 07-03 did not have a material impact on our Consolidated

Financial Statements.

In March 2008, the FASB issued Statement No. 161, “Disclosures about Derivative

Instruments and Hedging Activities—an amendment of FASB Statement No. 133” (“SFAS

No. 161”). SFAS No. 161 changes the disclosure requirements for derivative instruments and

hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an

entity uses derivative instruments, (b) how derivative instruments and related hedged items are

accounted for under Statement No. 133 and its related interpretations, and (c) how derivative

instruments and related hedged items affect an entity’s financial position, financial performance,

and cash flows. The guidance in SFAS No. 161 is effective for financial statements issued for

fiscal years and interim periods beginning after November 15, 2008, with early application

encouraged. SFAS No. 161 encourages, but does not require, comparative disclosures for earlier

periods at initial adoption. The adoption of SFAS No. 161 did not have a material impact on our

Consolidated Financial Statements.

In April 2008, the FASB issued FSP FAS 142-3, “Determination of the Useful Life of

Intangible Assets”. FSP FAS 142-3 amends the factors an entity should consider in developing

renewal or extension assumptions used in determining the useful life of recognized intangible

assets under SFAS No. 142, “Goodwill and Other Intangible Assets”. This guidance for

determining the useful life of a recognized intangible asset applies prospectively to intangible

assets acquired individually or with a group of other assets in either an asset acquisition or

business combination. FSP FAS 142-3 is effective for fiscal years, and interim periods within

those fiscal years, beginning after December 15, 2008, and early adoption is prohibited. The

adoption of FSP FAS 142-3 did not have a material impact on our Consolidated Financial

Statements.