Activision 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 46

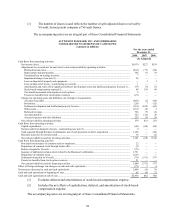

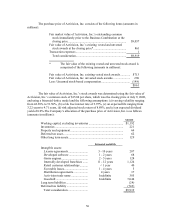

Financial Instruments

The estimated fair values of financial instruments have been determined using available

market information and valuation methodologies described below. However, considerable

judgment is required in interpreting market data to develop the estimates of fair value.

Accordingly, the estimates presented herein may not be indicative of the amounts that we could

realize in a current market exchange. The use of different market assumptions or valuation

methodologies may have a material effect on the estimated fair value amounts.

The carrying amount of cash and cash equivalents, accounts receivable, accounts payable,

and accrued expenses are a reasonable approximation of fair value due to their short-term nature.

Short-term investments are carried at fair value with fair values estimated based on quoted market

prices. Long-term investments are comprised of student loan backed taxable auction rate securities

(see Note 17 of the Notes to Consolidated Financial Statements for details). We account for

derivative instruments in accordance with SFAS No. 133, SFAS No. 138, “Accounting for Certain

Derivative Instruments and Certain Hedging Activities”, an amendment of SFAS No. 133 and

SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments and Hedging

Activities”. SFAS Nos. 133, 138, and 149 require that all derivatives, including foreign exchange

contracts, be recognized in the balance sheet in other assets or liabilities at their fair value. The fair

value of foreign currency contracts is estimated based on the prevailing exchange rates of the

various hedged currencies as of the end of the period.

Activision Blizzard transacts business in various foreign currencies and has significant

international sales and expenses denominated in foreign currencies, subjecting Activision Blizzard

to foreign currency risk. Activision Blizzard utilizes foreign exchange forward contracts to

mitigate foreign currency exchange rate risk associated with foreign-currency-denominated assets

and liabilities. The forward contracts generally have contractual terms of less than a year.

Activision Blizzard does not use foreign exchange forward contracts for speculative or trading

purposes. None of Activision Blizzard’s foreign exchange forward contracts were designated as

hedging instruments under SFAS No. 133. Accordingly, gains or losses resulting from changes in

the fair values of the forward contracts are reported as investment income, net in the Consolidated

Statements of Operations.

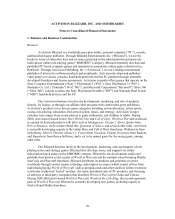

Software Development Costs and Intellectual Property Licenses

Software development costs include payments made to independent software developers

under development agreements, as well as direct costs incurred for internally developed products.

We account for software development costs in accordance with Statement of Financial

Accounting Standards No. 86, “Accounting for the Costs of Computer Software to Be Sold,

Leased, or Otherwise Marketed”, (“SFAS No. 86”). Software development costs are capitalized

once the technological feasibility of a product is established and such costs are determined to be

recoverable. Technological feasibility of a product encompasses both technical design

documentation and game design documentation, or the completed and tested product design and

working model. Significant management judgments and estimates are utilized in the assessment of

when technological feasibility is established. For products where proven technology exists, this

may occur early in the development cycle. Technological feasibility is evaluated on a product-by-

product basis. Prior to a product’s release, we expense, as part of “cost of sales—software

royalties and amortization”, capitalized costs when we believe such amounts are not recoverable.