Activision 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

we had $874 million available for utilization under the buyback program and no outstanding stock

repurchase transactions.

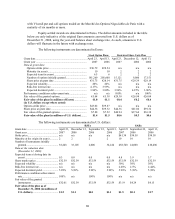

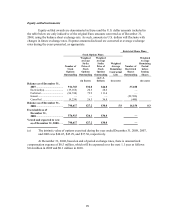

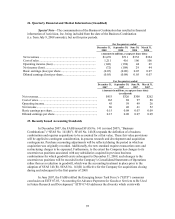

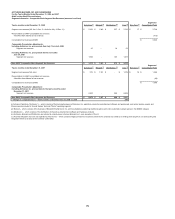

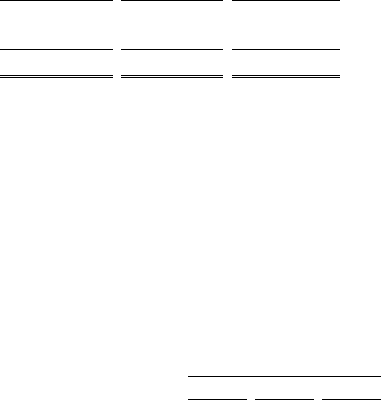

21. Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) for the year ended

December 31, 2008 were as follows (amounts in millions):

Foreign

currency

translation

adjustment

Unrealized

appreciation

(depreciation)

on

investments

Accumulated

other

comprehensive

income (loss)

Balance at December 31, 2007........................................ $40 $— $40

Other comprehensive income (loss) ................................ (81) (2) (83)

Balance at December 31, 2008........................................ $(41) $(2) $(43)

Other comprehensive income (loss) is presented net of taxes of $2 million related to net

unrealized depreciation on investments for the year ended December 31, 2008. Income taxes were

not provided for foreign currency translation items as these are considered indefinite investments

in non-U.S. subsidiaries.

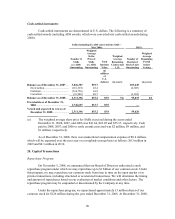

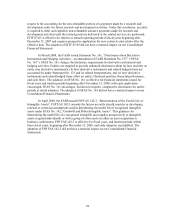

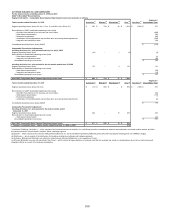

22. Supplemental Cash Flow Information

Non-cash investing and financing activities and supplemental cash flow information are

as follows (amounts in millions):

For the years ended

December 31,

2008 2007 2006

Supplemental cash flow information:

Cash paid for income taxes..................................................................................... $151 $22 $8

Cash paid for interest.............................................................................................. 2 (1) (1)

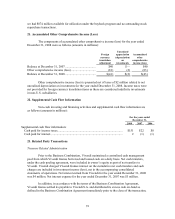

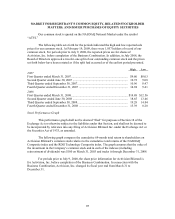

23. Related Party Transactions

Treasury Related Administration

Prior to the Business Combination, Vivendi maintained a centralized cash management

pool from which Vivendi Games borrowed and loaned cash on a daily basis. Net cash transfers,

under the cash pooling agreement, were included in owner’s equity as part of net transfers to

Vivendi. Vivendi charged Vivendi Games interest on the cumulative net cash transfers and such

charges are included in investment income (loss), net in the accompanying consolidated

statements of operations. Net interest earned from Vivendi for the year ended December 31, 2008

was $4 million. Net interest expense for the year ended December 31, 2007 was $3 million.

In addition, in accordance with the terms of the Business Combination Agreement,

Vivendi Games settled its payable to Vivendi S.A. and distributed its excess cash on-hand as

defined in the Business Combination Agreement immediately prior to the close of the transaction,