Activision 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

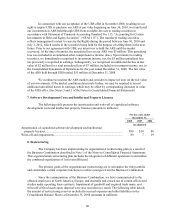

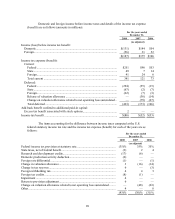

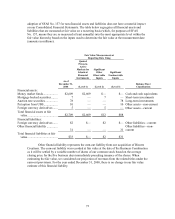

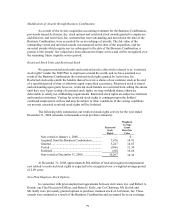

Deferred income taxes reflect the net tax effects of temporary differences between the

amounts of assets and liabilities for accounting purposes and the amounts used for income tax

purposes. At December 31, 2007, the components of the net deferred tax assets were presented on

the basis of what would be attributable to Vivendi Games if it were to be deconsolidated from

Vivendi or Vivendi’s subsidiaries. The components of the net deferred tax assets (liabilities) are as

follows (amounts in millions):

As of December 31,

2008 2007

(As Adjusted)

Deferred tax assets:

Reserves and allowances......................................................................................... $35 $18

Allowance for sales returns and price protection..................................................... 59 12

Inventory reserve..................................................................................................... 13 —

Accrued expenses.................................................................................................... 46 2

Accrued legal and professional fees ........................................................................ 28 —

Accrued restructuring.............................................................................................. 15 1

Deferred revenue..................................................................................................... 326 81

Deferred compensation............................................................................................ 1 2

Depreciation ............................................................................................................ 9 —

Tax credit carryforwards ......................................................................................... 30 29

Net operating loss carryforwards............................................................................. 24 28

State taxes................................................................................................................ 19 3

Stock-based compensation ...................................................................................... 58 74

Foreign deferred assets............................................................................................ 27 3

Other........................................................................................................................ 4 3

Deferred tax assets....................................................................................................... 694 256

Valuation allowance.................................................................................................... (22) (22)

Deferred tax assets, net of valuation allowance........................................................... 672 234

Deferred tax liabilities:

Intangibles ............................................................................................................... (691) (22)

Prepaid royalties...................................................................................................... (10) (38)

Capitalized software development expenses ........................................................... (50) —

Depreciation ............................................................................................................ — (2)

Other........................................................................................................................ — (5)

Deferred tax liabilities ......................................................................................... (751) (67)

Net deferred tax assets (liabilities) .............................................................................. $(79) $167

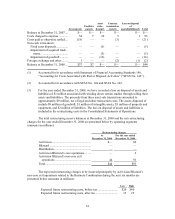

As of December 31, 2008, our available federal net operating loss carryforward of

approximately $1 million is subject to certain limitations as defined under Section 382 of the

Internal Revenue Code. The net operating loss carryforwards will begin to expire in 2023. We

have various state net operating loss carryforwards totaling $17 million which are not subject to

limitations under Section 382 of the Internal Revenue Code and will begin to expire in 2013. We

have tax credit carryforwards of $6 million and $25 million for federal and state purposes,

respectively, which begin to expire in fiscal 2016.

Through our foreign operations, we have approximately $77 million in net operating loss

carryforwards at December 31, 2008, attributed mainly to losses in France, Ireland, and Sweden.