Activision 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 75

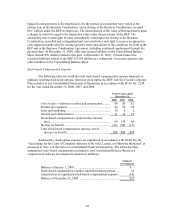

18. Commitments and Contingencies

Credit Facilities

We have revolving credit facilities with our Centresoft subsidiary located in the UK (the

“UK Facility”) and our NBG subsidiary located in Germany (the “German Facility”). The UK

Facility provided Centresoft with the ability to borrow up to GBP 12 million ($18 million),

including issuing letters of credit, on a revolving basis at December 31, 2008. The UK Facility

bore interest at the London Inter-bank Offer Rate (“LIBOR”) plus 2.0% at December 31, 2008, is

collateralized by substantially all of the assets of the subsidiary and will expire in March 2009.

The UK Facility contains various covenants that require the subsidiary to maintain specified

financial ratios related to, among others, fixed charges. The German Facility provided for

revolving loans up to EUR 1 million ($1 million) at December 31, 2008, bore interest at a

Eurocurrency rate plus 2.5%, is collateralized by certain of the subsidiary’s property and

equipment and has no expiration date. No borrowings were outstanding against the UK Facility or

the German Facility at December 31, 2008.

At December 31, 2008, we maintained a $35 million irrevocable standby letter of credit.

The standby letter of credit is required by one of our inventory manufacturers to qualify for

payment terms on our inventory purchases. Under the terms of this arrangement, we are required

to maintain on deposit with the bank a compensating balance, restricted as to use, of not less than

the sum of the available amount of the letter of credit plus the aggregate amount of any drawings

under the letter of credit that have been honored thereunder but not reimbursed. At December 31,

2008, the $35 million deposit is included in short-term investments as restricted cash. The letter of

credit was undrawn at December 31, 2008.

At December 31, 2008, our publishing subsidiary located in the UK maintained a EUR

25 million ($35 million) irrevocable standby letter of credit. The standby letter of credit is required

by one of our inventory manufacturers to qualify for payment terms on our inventory purchases.

The standby letter of credit does not require a compensating balance and is collateralized by

substantially all of the assets of the subsidiary and expires in April 2010. No borrowings were

outstanding at December 31, 2008.

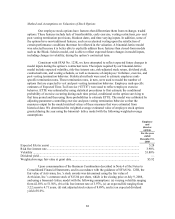

On April 29, 2008, Activision, Inc. entered into a senior unsecured credit agreement with

Vivendi (as lender). Borrowings under the agreement became available upon consummation of the

Business Combination. At December 31, 2008, the credit agreement provides for a revolving

credit facility of up to $475 million, bearing interest at LIBOR plus 1.20% per annum. Any unused

amount under the revolving credit facility is subject to a commitment fee of 0.42% per annum.

The revolving credit facility is subject to customary negative covenants, in each case

subject to certain exceptions and qualifications, including limitations on: indebtedness; liens;

investments, mergers, consolidations and acquisitions; transactions with affiliates; issuance of

preferred stock by subsidiaries; sale and leaseback transactions, restricted payments and certain

restrictions with respect to subsidiaries. The limitation on indebtedness provides that Activision

Blizzard cannot incur consolidated indebtedness, net of unrestricted cash, in excess of $1.5 billion,

and that no additional indebtedness may be incurred as long as the ratio of Activision Blizzard’s

consolidated indebtedness (including the indebtedness to be incurred) minus the amount of

unrestricted cash to Activision Blizzard’s consolidated earnings before interest, taxes, depreciation

and amortization for its most recently ended four quarters would be greater than 1.50 to 1.0. This