Activision 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 86

• When the equity awards grant entitlement to the value of Vivendi shares, they are

known as “restricted stock units” (“RSUs”), which are the economic equivalent of

restricted shares;

• Vivendi has converted the former American Depositary Shares (“ADS”) stock option

plans for its U.S. resident employees into SARs plans; and

• SARs and RSUs are denominated in U.S. dollars.

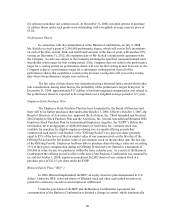

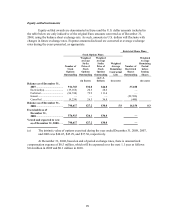

Stock Appreciation Rights (SARs) plans

Under SARs plans, the employees will receive, upon exercise of their rights, a cash

payment based on the Vivendi share price, equal to the difference between the Vivendi share price

upon exercise of the SARs and their strike price as set at the grant date. Similar to stock option

plans set up before January 1, 2007, rights vest annually in one-third tranches on the grant date’s

anniversary. Two-thirds of those vested SARs become exercisable at the beginning of the third

anniversary of the grant date and the remaining one-third becomes exercisable at the beginning of

the fourth anniversary of the grant date. The compensation cost of the SARs granted before 2007

is recorded over the vesting period but not on a straight-line basis, as the SARs under the plan vest

in one-third tranches over three years. The expense is accounted for over the required service

period using the accelerated multi-tranche method in accordance with the following spread rates:

61% in the first year of the plan, 28% in the second year, and 11% in the third year.

In 2007, Vivendi Games employees received SARs which cliff vest at the end of a three-

year vesting period. Therefore, the compensation cost of these SARs is recognized on a straight-

line basis over the vesting period.

The fair value of these plans is re-measured at each quarter end until the exercise date/the

exercise of the rights and the expense adjusted pro rata to vested rights at the relevant reporting

date.

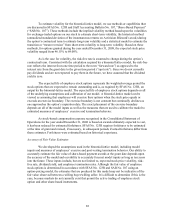

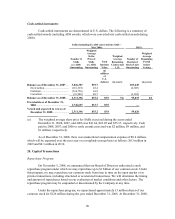

Restricted Stock Unit (RSUs) plans

In 2006, Vivendi established RSU plans for certain U.S. resident executives and

employees. Granting of shares under these plans to the U.S. resident executives and employees is

triggered by the achievement of certain operating objectives as set forth in Vivendi’s annual

budget, and then cliff vest at the end of a two-year vesting period. The operating objectives for

granting the RSUs were satisfied in 2006 and 2007. The participant will receive a cash payment

equal to the value of the RSUs two years after vesting. The value of the RSUs will be based on the

value of Vivendi shares at the time the cash payment is made, plus the value of dividends paid on

Vivendi shares during the two year period after vesting (converted into local currency based on

prevailing exchange rates).

Compensation cost in respect of the RSU plans is recognized on a straight-line basis over

the two-year vesting period. The value of the plan is re-measured at each quarter end until the date

of payment and the compensation cost adjusted accordingly, pro rata to rights vested at the

relevant reporting date.