Activision 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

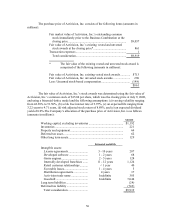

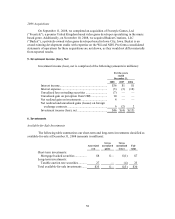

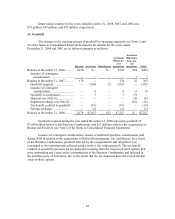

The purchase price of Activision, Inc. consists of the following items (amounts in

millions):

Fair market value of Activision, Inc.’s outstanding common

stock immediately prior to the Business Combination at the

closing price...........................................................................

.

$9,057

Fair value of Activision, Inc.’s existing vested and unvested

stock awards at the closing price*..........................................

.

861

Transaction expenses.................................................................

.

1

Total consideration.................................................................

.

$9,919

* The fair value of the existing vested and unvested stock award is

comprised of the following (amounts in millions):

Fair value of Activision, Inc. existing vested stock awards............. $713

Fair value of Activision, Inc. unvested stock awards....................... 296

Less: Unearned stock-based compensation...................................... (148)

$861

The fair value of Activision, Inc.’s stock awards was determined using the fair value of

Activision, Inc.’s common stock of $15.04 per share, which was the closing price at July 9, 2008,

and using a binomial-lattice model and the following assumptions: (a) varying volatility ranging

from 42.38% to 51.50%, (b) a risk free interest rate of 3.97%, (c) an expected life ranging from

3.22 years to 4.71 years, (d) risk adjusted stock return of 8.89%, and (e) an expected dividend

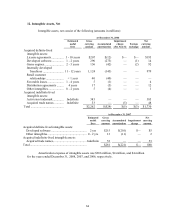

yield of 0.0%.The Company’s allocation of the purchase price of Activision, Inc. is as follows

(amounts in millions):

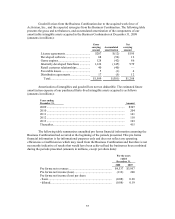

Amount

Working capital, excluding inventories............................................. $1,192

Inventories ......................................................................................... 221

Property and equipment..................................................................... 64

Deferred tax asset............................................................................... 62

Other long term assets........................................................................ 129

Estimated useful life

Intangible assets:

License agreements.........................

.

3 - 10 years 207

Developed software ........................

.

1 - 2 years 68

Game engines..................................

.

2 - 5 years 128

Internally developed franchises ......

.

11 - 12 years 1,124

Retail customer relationships..........

.

< 1 year 40

Favorable leases..............................

.

1 - 4 years 5

Distribution agreements..................

.

4 years 17

Activision trade name.....................

.

Indefinite 385

Goodwill .........................................

.

Indefinite 7,044

Long term liabilities............................

.

(24)

Deferred tax liability...........................

.

(743)

Total consideration .........................

.

$9,919