Activision 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

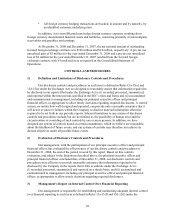

At December 31, 2008, we maintained a $35 million irrevocable standby letter of credit

required by one of our inventory manufacturers to qualify for payment terms on our inventory

purchases. The letter of credit was undrawn at December 31, 2008.

At December 31, 2008, our publishing subsidiary located in the UK maintained a EUR

25 million ($35 million) irrevocable standby letter of credit. The standby letter of credit is required

by one of our inventory manufacturers to qualify for payment terms on our inventory purchases.

The standby letter of credit does not require a compensating balance, is collateralized by

substantially all of the assets of the subsidiary and expires in February 2009. No borrowings were

outstanding at December 31, 2008.

On April 29, 2008, Activision, Inc. entered a senior unsecured credit agreement with

Vivendi (as lender). At December 31, 2008, the credit agreement provides for a revolving credit

facility of up to $475 million. No borrowings were outstanding at December 31, 2008.

Commitments

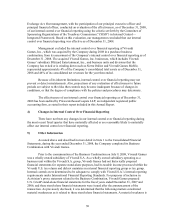

In the normal course of business, we enter into contractual arrangements with

third-parties for non-cancelable operating lease agreements for our offices, for the development of

products, and for the rights to intellectual property (“IP”). Under these agreements, we commit to

provide specified payments to a lessor, developer or intellectual property holder, as the case may

be, based upon contractual arrangements. The payments to third-party developers are generally

conditioned upon the achievement by the developers of contractually specified development

milestones. Further, these payments to third-party developers and intellectual property holders

typically are deemed to be advances and are recoupable against future royalties earned by the

developer or intellectual property holder based on the sale of the related game. Additionally, in

connection with certain intellectual property rights acquisitions and development agreements, we

commit to spend specified amounts for marketing support for the related game(s) which is to be

developed or in which the intellectual property will be utilized. Assuming all contractual

provisions are met, the total future minimum commitments for these and other contractual

arrangements in place at December 31, 2008 are scheduled to be paid as follows (amounts in

millions):

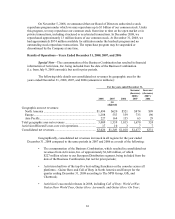

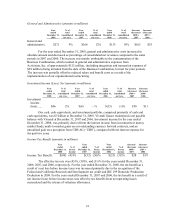

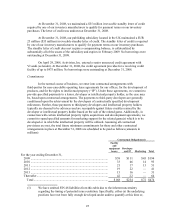

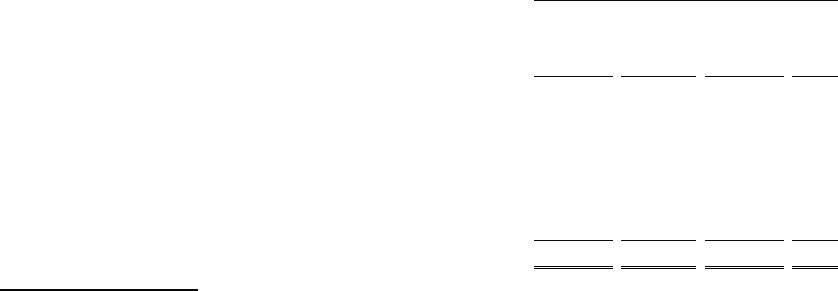

Contractual Obligations(1)

Facility

and

equipment

leases Developer

and IP Marketing Total

For the year ending December 31,

2009 ..................................................................................................... $38 $111 $45 $194

2010 ..................................................................................................... 33 46 14 93

2011 ..................................................................................................... 21 17 13 51

2012 ..................................................................................................... 19 22 — 41

2013 ..................................................................................................... 15 16 — 31

Thereafter............................................................................................. 42 22 — 64

Total................................................................................................. $168 $234 $72 $474

(1) We have omitted FIN 48 liabilities from this table due to the inherent uncertainty

regarding the timing of potential issue resolution. Specifically, either (a) the underlying

positions have not been fully enough developed under audit to quantify at this time or,