Activision 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 24

our ARS held through UBS at par value, which is defined as the price equal to the liquidation

preference of the ARS plus accrued but unpaid dividends or interest, at any time during the period

of June 30, 2010 through July 2, 2012. Conversely, UBS has the right, in its discretion, to

purchase or sell our ARS at any time until July 2, 2012, so long as we receive payment at par

value upon any sale or disposition. If auctions continue to fail, we expect to sell our ARS under

the Rights. However, if the Rights are not exercised before July 2, 2012 they will expire and UBS

will have no further rights or obligation to buy our ARS. So long as we hold our ARS, they will

continue to accrue interest as determined by the auction process or the terms of the ARS if the

auction process fails.

UBS’s obligations under the Rights are not secured by its assets and do not require UBS

to obtain any financing to support its performance obligations under the Rights. UBS has

disclaimed any assurance that it will have sufficient financial resources to satisfy its obligations

under the Rights.

The fair value of auction rate securities through UBS and Citi totaled $55 million and

$23 million, respectively, at December 31, 2008.

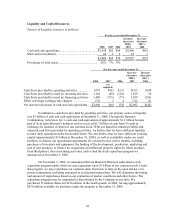

Based on our other available cash and expected operating cash flows and financing, we

do not anticipate that the potential lack of liquidity on these investments will affect our ability to

execute our current business plan.

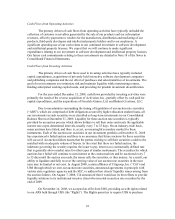

Cash Flows from Financing Activities

The primary drivers of cash flows provided by financing activities have historically

related to transactions involving our common stock, including the issuance of our common stock

to employees and the public and the purchase of treasury shares. We have not utilized debt

financing as a significant source of cash flows. However, if needed, we may access and utilize the

credit facilities that are described in “Credit Facilities” in Note 18 of the Notes to Consolidated

Financial Statements.

Capital Requirements

For the year ending December 31, 2009, we anticipate total capital expenditures of

approximately $118 million. Capital expenditures will be primarily for computer hardware and

software purchases and various corporate projects.

Credit Facilities

We have revolving credit facilities with our Centresoft subsidiary located in the UK (the

“UK Facility”) and our NBG subsidiary located in Germany (the “German Facility”). The UK

Facility provides Centresoft with the ability to borrow up to 12 million Great British Pound

Sterling (“GBP”) ($18 million), including issuing letters of credit, on a revolving basis at

December 31, 2008. The German Facility provides for revolving loans up to 1 million Euro

(“EUR”) ($1 million) at December 31, 2008. No borrowings were outstanding against the UK

Facility or the German Facility at December 31, 2008.