Activision 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 87

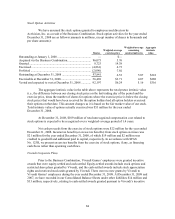

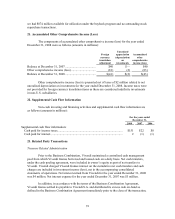

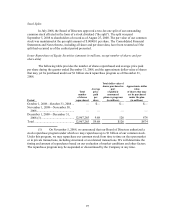

Conversion of the former ADS option plans into SAR plans in May 2006

On May 15, 2006, the ADS option plans for U.S. resident employees were converted into

SARs plans. The terms and conditions of these awards remained unchanged (exercise price,

vesting period, maturity, etc.), except that such awards are to be cash-settled. As a result, the

estimated fair value of the vested rights of these plans on May 15, 2006 ($19 million) was

recorded as a liability as at the conversion date. When initially recording this liability, $15 million

was charged as compensation expense in 2006 and $4 million was reclassified from shareholder’s

equity, at the date of conversion.

Restricted shares or restricted stock to each employee

On December 12, 2006, Vivendi established a grant of 15 fully vested restricted shares

without any performance conditions for all non-temporary employees resident in France, who

were employed and who had been employed by Vivendi Games for at least six months at that date.

The 15 shares granted to each employee were issued at the end of a two-year period from the grant

date. At the end of this two-year period, the restricted shares will remain restricted for an

additional two-year period. As the shares granted are ordinary shares of the same class as Vivendi

outstanding shares making up the share capital of Vivendi, employee shareholders became entitled

to dividends and voting rights relating to all their shares upon their issuance. As these restricted

shares were fully vested when granted, the compensation cost was recognized in full on the grant

date.

For all non-temporary employees resident outside France, who were employed and who

had been employed by Vivendi Games for at least six months as of December 12, 2006, Vivendi

established a 15 RSU plan without any performance conditions. In general, the RSUs granted will

be paid out in cash after a four-year period from the date of grant in an amount equal to the value

of the Vivendi shares at the time the cash payment is made, plus the value of dividends paid on the

Vivendi shares in the last two fiscal years prior to payment. RSUs are simply units of account and

do not have any value outside the context of this plan. RSUs do not have voting rights, and they do

not represent or imply an ownership interest in Vivendi or any of its businesses. Given the

immediate vesting of such grant, the compensation cost was recognized in full on the grant date

against liability and is re-measured at each quarter end until the date of payment.

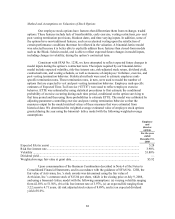

Method and Assumptions on Valuation of Vivendi Corporate Plans

Vivendi Games estimated the fair value of stock-based awards granted using a binomial

option-pricing model. For purposes of determining the expected term and in the absence of

historical data relating to stock options exercises, Vivendi Games applied a simplified approach:

the expected term of equity-settled instruments granted was presumed to be the mid-point between

the vesting date and the end of the contractual term. For cash-settled instruments, the expected

term applied was equal to:

• for rights that can be exercised, one-half of the residual contractual term of the

instrument at the reporting date; and

• for rights that cannot be exercised yet, the average of the residual vesting period and

the residual contractual term of the instrument at the reporting date.

For stock-based awards in Vivendi stock, the computed volatility corresponds to the

average of Vivendi’s three-year historical volatility and its implied volatility, which is determined