Activision 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

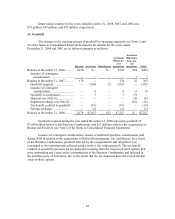

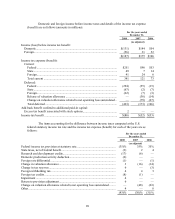

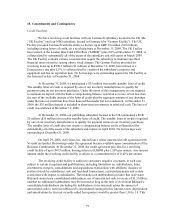

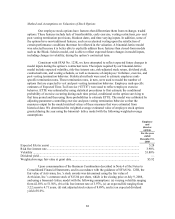

adoption of SFAS No. 157 for non-financial assets and liabilities does not have a material impact

on our Consolidated Financial Statements. The table below segregates all financial assets and

liabilities that are measured at fair value on a recurring basis (which, for purposes of SFAS

No. 157, means they are so measured at least annually) into the most appropriate level within the

fair value hierarchy based on the inputs used to determine the fair value at the measurement date

(amounts in millions):

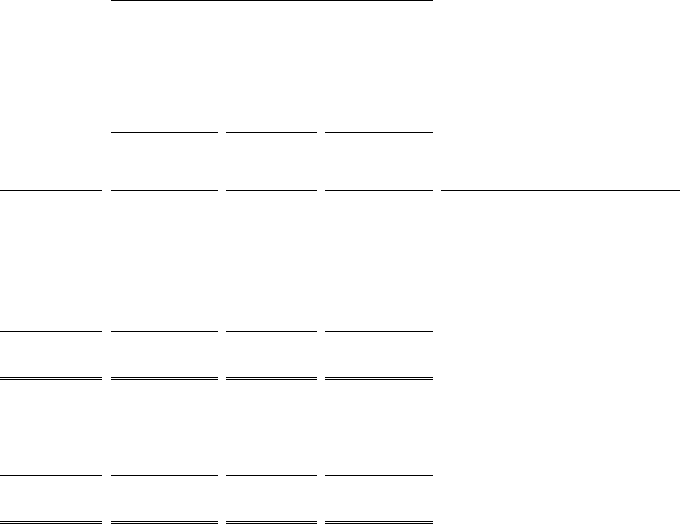

Fair Value Measurements at

Reporting Date Using

Quoted

Prices in

Active

Markets for

Identical

Financial

Instruments

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

As of

December 31,

2008 (Level 1) (Level 2) (Level 3) Balance Sheet

Classification

Financial assets:

Money market funds................... $2,609 $2,609 $— $— Cash and cash equivalents

Mortgage backed securities........ 7 — 7 — Short-term investments

Auction rate securities................ 78 — — 78 Long-term investments

Put option from UBS.................. 10 — — 10 Other assets—non-current

Foreign currency derivatives...... 5 — 5 — Other assets—current

Total financial assets at fair

value....................................... $2,709 $2,609 $12 $88

Financial liabilities:

Foreign currency derivatives...... $2 $— $2 $— Other liabilities—current

Other financial liability .............. 31 — — 31 Other liabilities—non-

current

Total financial liabilities at fair

value....................................... $33 $— $2 $31

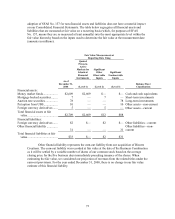

Other financial liability represents the earn-out liability from our acquisition of Bizarre

Creations. The earn-out liability was recorded at fair value at the date of the Business Combination

as it will be settled by a variable number of shares of our common stock based on the average

closing price for the five business days immediately preceding issuance of the shares. When

estimating the fair value, we considered our projection of revenues from the related titles under the

earn-out provisions. For the year ended December 31, 2008, there is no change in our fair value

estimate of this financial liability.