Activision 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 53

protection related to current period product revenue. We estimate the amount of future returns and

price protection for current period product revenue utilizing historical experience and information

regarding inventory levels and the demand and acceptance of our products by the end consumer.

The following factors are used to estimate the amount of future returns and price protection for a

particular title: historical performance of titles in similar genres; historical performance of the

hardware platform; historical performance of the franchise; console hardware life cycle; sales

force and retail customer feedback; industry pricing; weeks of on-hand retail channel inventory;

absolute quantity of on-hand retail channel inventory; our warehouse on-hand inventory levels; the

title’s recent sell-through history (if available); marketing trade programs; and competing titles.

The relative importance of these factors varies among titles depending upon, among other items,

genre, platform, seasonality, and sales strategy. Significant management judgments and estimates

must be made and used in connection with establishing the allowance for returns and price

protection in any accounting period. Based upon historical experience, we believe that our

estimates are reasonable. However, actual returns and price protection could vary materially from

our allowance estimates due to a number of reasons including, among others, a lack of consumer

acceptance of a title, the release in the same period of a similarly themed title by a competitor, or

technological obsolescence due to the emergence of new hardware platforms. Material differences

may result in the amount and timing of our revenue for any period if factors or market conditions

change or if management makes different judgments or utilizes different estimates in determining

the allowances for returns and price protection. For example, a 1% change in our December 31,

2008 allowance for returns and price protection would impact net revenues by approximately

$3 million.

Similarly, management must make estimates of the uncollectibility of our accounts

receivable. In estimating the allowance for doubtful accounts, we analyze the age of current

outstanding account balances, historical bad debts, customer concentrations, customer

creditworthiness, current economic trends, and changes in our customers’ payment terms and their

economic condition, as well as whether we can obtain sufficient credit insurance. Any significant

changes in any of these criteria would affect management’s estimates in establishing our

allowance for doubtful accounts.

We value inventory at the lower of cost or market. We regularly review inventory

quantities on-hand and in the retail channel and record a provision for excess or obsolete inventory

based on the future expected demand for our products. Significant changes in demand for our

products would impact management’s estimates in establishing our inventory provision.

Shipping and Handling

Shipping and handling costs, which consist primarily of packaging and transportation

charges incurred to move finished goods to customers, are included in “cost of sales—product

costs.”

Advertising Expenses

We expense advertising as incurred, except for production costs associated with media

advertising which are deferred and charged to expense the first time the related ad is run.

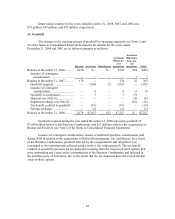

Advertising expenses for the years ended December 31, 2008, 2007, and 2006 were $241 million,

$73 million, and $73 million, respectively, and are included in sales and marketing expense in the

Consolidated Statements of Operations.