Activision 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 49

In completing our goodwill impairment analysis, we test the appropriateness of our

reporting units’ estimated fair value by reconciling the aggregate reporting units’ fair values with

our market capitalization. Our impairment analysis indicated that the aggregate fair values of our

reporting units exceeded our average December 2008 market capitalization by approximately

$4.6 billion or 34%. We believe it is appropriate to consider a one month average market

capitalization given the overall market conditions which have depressed our stock value, and the

trends of our stock performance subsequent to December 31, 2008 has proven that the closing

price at December 31, 2008 (i.e. at a particular point in time) does not represent our Company’s

fair value. The fair value of an entity can be greater than its market capitalization for various

reasons, one of which is the concept of control premium. A control premium is the amount that a

buyer is willing to pay over the current market price of a company to acquire a controlling interest.

Substantial value may arise from the ability to take advantages of synergies, such as the expected

increase in cash flow resulting from cost savings and revenue enhancements, and other benefits

could be achieved by controlling another entity. We also believe the general downtown in U.S.

equity markets resulting from the recent credit and liquidity crisis, which we believe has also

affected our stock market valuation, is not representative of any fundamental change in our

businesses. However, changes in our assumptions underlying our estimates of fair value, which

will be a function of our future financial performance and changes in economic conditions, could

result in future impairment charges.

We test acquired trade names for possible impairment by using a discounted cash flow

model to estimate fair value. The estimated fair values of each of our acquired trade names

exceeded their carrying values by a range of approximately $12 million to $90 million. As such,

we have determined that no impairment has occurred at December 31, 2008 based upon a set of

assumptions regarding discounted future cash flows, which represent our best estimate of future

performance at this time. In determining the fair value of our trade names, we assumed a discount

rate of 13% and royalty saving rates of approximately 1%. A one percentage point increase in the

discount rate would have reduced the indicated fair values of each of our acquired trade names by

a range of approximately $16 million to $46 million. Changes in our assumptions underlying our

estimates of fair value, which will be a function of our future financial performance and changes

in economic conditions, could result in a future impairment charges.

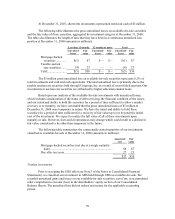

Amortizable Intangible Assets. Intangible assets subject to amortization are carried at

cost less accumulated amortization. Amortizable intangible assets consist of internally developed

franchises, acquired developed software, acquired game engines, favorable leases, and distribution

agreements, and other intangible assets related primarily to licensing activities and retail customer

relationships. Intangible assets subject to amortization are amortized over the estimated useful life

in proportion to the economic benefits received.

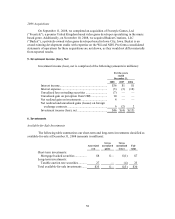

Management evaluates the recoverability of our identifiable intangible assets and other

long-lived assets in accordance with SFAS No. 144, “Accounting for the Impairment or Disposal

of Long-lived Assets,” which generally requires the assessment of these assets for recoverability

when events or circumstances indicate a potential impairment exists. We considered certain events

and circumstances in determining whether the carrying value of identifiable intangible assets and

other long-lived assets may not be recoverable including, but are not limited to: significant

changes in performance relative to expected operating results; significant changes in the use of the

assets; significant negative industry or economic trends; a significant decline in our stock price for

a sustained period of time; and changes in our business strategy. In determining if an impairment

exists, we estimate the undiscounted cash flows to be generated from the use and ultimate