Activision 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

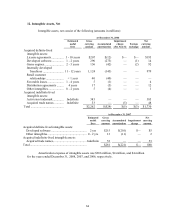

57

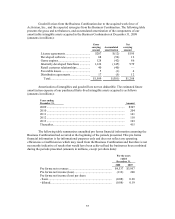

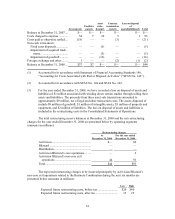

Goodwill arises from the Business Combination due to the acquired work force of

Activision, Inc., and the expected synergies from the Business Combination. The following table

presents the gross and net balances, and accumulated amortization of the components of our

amortizable intangible assets acquired in the Business Combination at December 31, 2008

(amounts in millions):

Gross

carrying

amount Accumulated

amortization

Net

carrying

amount

License agreements................................

.

$207 $(12) $195

Developed software ...............................

.

68 (56) 12

Game engines.........................................

.

128 (42) 86

Internally developed franchises .............

.

1,124 (145) 979

Retail customer relationships.................

.

40 (40) —

Favorable leases.....................................

.

5(1)4

Distribution agreements.........................

.

17 (5) 12

Total...................................................

.

$1,589 $(301) $1,288

Amortization of intangibles and goodwill are not tax deductible. The estimated future

amortization expense of our purchased finite-lived intangible assets acquired is as follows

(amounts in millions):

Years ending

December 31, Amount

2009 .....................................................................................................

.

$307

2010 .....................................................................................................

.

204

2011 .....................................................................................................

.

141

2012 .....................................................................................................

.

118

2013 .....................................................................................................

.

103

Thereafter.............................................................................................

.

415

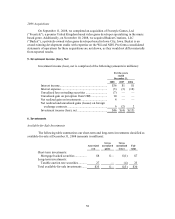

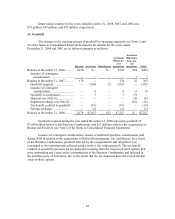

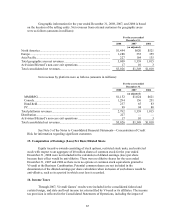

The following table summarizes unaudited pro forma financial information assuming the

Business Combination had occurred at the beginning of the periods presented. This pro forma

financial information is for informational purposes only and does not reflect any operating

efficiencies or inefficiencies which may result from the Business Combination and therefore is not

necessarily indicative of results that would have been achieved had the businesses been combined

during the periods presented (amounts in millions, except per share data):

For the years

ended

December 31,

2008 2007

Pro forma net revenues.......................................................

.

$4,337 $3,957

Pro forma net income (loss)................................................

.

(112) 260

Pro forma net income (loss) per share

- basic..................................................................................

.

(0.08) 0.20

- diluted...............................................................................

.

(0.08) 0.19