Activision 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

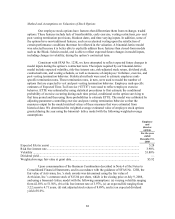

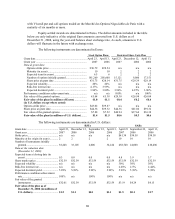

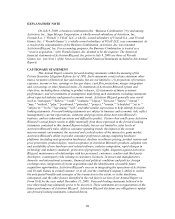

with Vivendi put and call options traded on the Marché des Options Négociables de Paris with a

maturity of six months or more.

Equity-settled awards are denominated in Euros. The dollar amounts included in the table

below are only indicative of the original Euro amounts converted into U.S. dollars as of

December 31, 2008, using the year-end balance sheet exchange rate. As such, amounts in U.S.

dollars will fluctuate in the future with exchange rates.

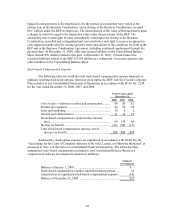

The following instruments are denominated in Euros:

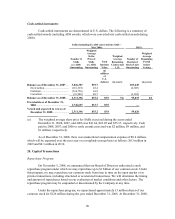

Stock Option Plans Restricted Share Units Plan

Grant date.......................................................................... April 23, April 13, April 23, December 12, April 13,

Grant year ......................................................................... 2007 2006 2007 2006 2006

Data at grant date:

Options strike price....................................................... €30.79 €28.54 n/a n/a n/a

Maturity (in years)........................................................ 10 10 2 2 2

Expected term (in years)............................................... 6.5 6 2 2 2

Number of options initially granted.............................. 181,260 205,600 15,121 9,000 17,151

Share price at grant date ............................................... €31.75 €28.14 €31.75 €29.39 €28.14

Expected volatility........................................................ 20% 26% n/a n/a n/a

Risk-free interest rate.................................................... 4.17% 3.99% n/a n/a n/a

Expected dividend yield ............................................... 3.94% 3.80% 3.94% 4.25% 3.80%

Performance conditions achievement rate......................... n/a n/a 100% n/a 100%

Fair value of the granted options....................................... €5.64 €5.38 €29.30 €26.94 €26.04

Fair value of the plan (in millions of Euros) ................. €1.0 €1.1 €0.4 €0.2 €0.4

(in U.S. dollars except where noted)

Options strike price........................................................... $43.02 $39.87 n/a n/a n/a

Share price at grant date.................................................... $44.36 $39.32 $44.36 $41.06 $39.32

Fair value of the granted options....................................... $7.88 $7.52 $40.94 $37.64 $36.38

Fair value of the plan (in millions of U.S. dollars)........ $1.4 $1.5 $0.6 $0.3 $0.6

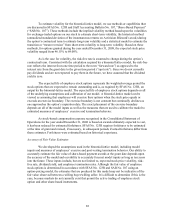

The following instruments are denominated in U.S. dollars:

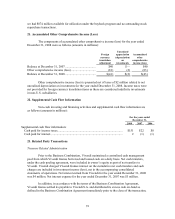

RSUs SARs

Grant date ............................................

.

April 23, December 12, September 22, April 13, April 23 September 22, April 13,

Grant year............................................

.

2007 2006 2006 2006 2007 2006 2006

Strike price...........................................

.

n/a n/a n/a n/a $41.34 $34.58 $34.58

Maturity at the origin (in years)...........

.

2 2 2 2 10 10 10

Number of instruments initially

granted.............................................

.

38,248 33,105 2,000 34,224 458,740 24,000 410,400

Data at the valuation date

(December 31, 2008):

Expected term at closing date (in

years)...............................................

.

0.3 0.0 0.0 0.0 4.8 3.9 3.7

Share market price ...............................

.

$32.59 $32.59 $32.59 $32.59 $32.59 $32.59 $32.59

Expected volatility...............................

.

n/a n/a n/a n/a 30% 30% 30%

Risk-free interest rate...........................

.

n/a n/a n/a n/a 2.68% 2.5% 2.44%

Expected dividend yield.......................

.

5.98% 5.98% 5.98% 5.98% 5.98% 5.98% 5.98%

Performance condition achievement

rate...................................................

.

100% n/a 100% 100% n/a n/a n/a

Fair value of the granted

instruments......................................

.

$32.01 $32.59 $32.59 $32.59 $3.19 $4.24 $4.15

Fair value of the plan as of

December 31, 2008 (in millions of

U.S. dollars)....................................

.

$1.2 $1.1 $0.1 $1.1 $1.5 $0.1 $1.7