Activision 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Activision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

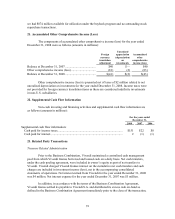

81

triggered cash payments to the beneficiaries for the portion of awards that were vested at the

closing date of the Business Combination. Upon closing of the Business Combination, we paid

$107 million under the BEP to employees. The determination of the value of Blizzard shares upon

a change in control is equal to the transaction value under the provisions of the BEP. The

outstanding non-vested rights became immediately vested upon the closing of the Business

Combination, cancelled and extinguished and converted into a new right to receive an amount in

cash eighteen months after the closing upon the terms and subject to the conditions set forth in the

BEP and in the Business Combination Agreement, including continued employment through the

payment date. At December 31, 2008, other non-current liabilities in the Consolidated Balance

Sheet include $70 million related to this plan. At December 31, 2007, Vivendi Games has

recorded liabilities related to the BEP of $144 million as a component of accrued expenses and

other liabilities in the Consolidated Balance Sheet.

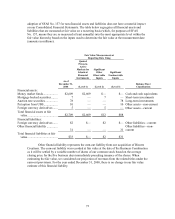

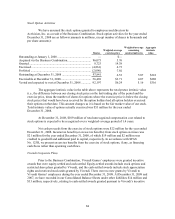

Stock-based Compensation Expense

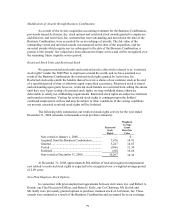

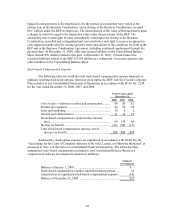

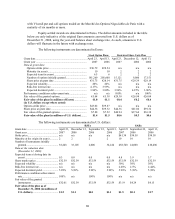

The following table sets forth the total stock-based compensation expense (amounts in

millions) resulting from stock options, restricted stock rights, the BEP, and the Vivendi Corporate

Plan included in our Consolidated Statements of Operations in accordance with SFAS No. 123R

for the year ended December 31, 2008, 2007, and 2006:

For the years ended

December 31,

2008 2007 2006

Cost of sales—software royalties and amortization.........

.

$4 $3 $1

Product development .......................................................

.

44 93 20

Sales and marketing.........................................................

.

10 8 2

General and administrative ..............................................

.

31 34 25

Stock-based compensation expense before income

taxes.............................................................................

.

89 138 48

Income tax benefit ...........................................................

.

(35) (54) (19)

Total stock-based compensation expense, net of

income tax benefit........................................................

.

$54 $84 $29

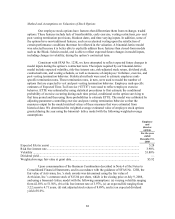

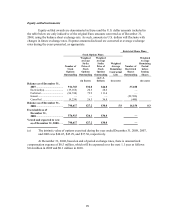

Additionally, stock option expenses are capitalized in accordance with SFAS No. 86,

“Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise Marketed” as

discussed in Note 1 of the Notes to Consolidated Financial Statements. The following table

summarizes stock-based compensation included in our Consolidated Balance Sheets as a

component of software development (amounts in millions):

Software

development

Balance at January 1, 2008 ..........................................................

.

$—

Stock-based compensation expense capitalized during period ....

.

32

Amortization of capitalized stock-based compensation expense.

.

(10)

Balance at December 31, 2008 ....................................................

.

$22