WeightWatchers 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

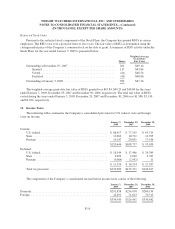

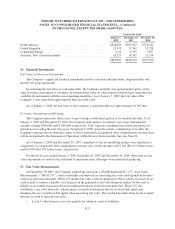

For the Fiscal Quarters Ended

March 31,

2007

June 30,

2007

September 29,

2007

December 29,

2007

Fiscal year ended December 29, 2007

Revenues, net ..................................... $399,401 $386,277 $337,450 $344,039

Gross profit ....................................... 226,107 219,616 187,927 180,286

Operating income .................................. 115,745 123,291 106,499 90,072

Net income ....................................... 53,826 58,023 49,511 39,820

Basic EPS ........................................ 0.63 0.74 0.63 0.50

Diluted EPS ....................................... 0.63 0.73 0.62 0.50

Basic and diluted EPS are computed independently for each of the periods presented. Accordingly, the sum

of the quarterly EPS amounts may not agree to the total for the year.

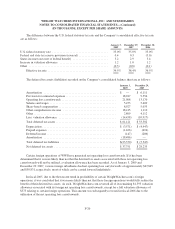

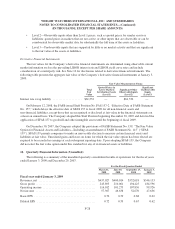

As discussed in further detail in Note 14, in the second quarter of fiscal 2008, the Company received an

adverse ruling with respect to the imposition of VAT on revenues earned by its U.K. subsidiary. In connection with

this ruling, the Company recorded a charge of approximately $32,500 as an offset to revenue in the second quarter

of fiscal 2008. Beginning in the third quarter of fiscal 2008, the Company recorded as an offset to revenue VAT

charges associated with U.K. meeting fees as earned, consistent with the aforementioned ruling. These charges were

approximately $1,800 in the third quarter of fiscal 2008 and approximately $1,400 in the fourth quarter of fiscal

2008. Furthermore, as a result of the expiration of the statutory time period with respect to U.K. VAT owed prior to

October 1, 2005, the Company recorded in the fourth quarter of fiscal 2008 as a benefit to revenue for the periods

prior to October 1, 2005 an amount of approximately $9,200 as an offset against reserves previously recorded

including in part the charge recorded against revenue in the second quarter of fiscal 2008.

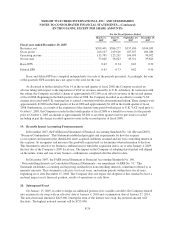

19. Recently Issued Accounting Pronouncements

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (Revised 2007),

“Business Combinations”. This Statement established principles and requirements for how the acquirer

(a) recognizes and measures the identifiable assets acquired, liabilities assumed and any non-controlling interest in

the acquiree; (b) recognizes and measures the goodwill acquired and (c) determines what information to disclose.

This Statement is effective for business combinations for which the acquisition date is on or after January 4, 2009,

the first day of the Company’s 2009 fiscal year. The impact on the Company of adopting this standard will depend

on the nature, terms and size of any business combinations completed after the effective date.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160,

“Noncontrolling Interests in Consolidated Financial Statements—an amendment of ARB No. 51.” This

Statement establishes accounting and reporting standards for noncontrolling interests, sometimes referred to as

minority interests. This statement is effective for fiscal years, and interim periods within those fiscal years,

beginning on or after December 15, 2008. The Company does not expect the adoption of this standard to have a

material impact on its financial position, results of operations or cash flows.

20. Subsequent Event

On January 13, 2009, in order to hedge an additional portion of its variable rate debt, the Company entered

into an interest rate swap with an effective date of January 4, 2010 and a termination date of January 27, 2014.

The initial notional amount is $425,000. During the term of the interest rate swap, the notional amount will

fluctuate. The highest notional amount will be $755,000.

F-29