WeightWatchers 2008 Annual Report Download - page 55

Download and view the complete annual report

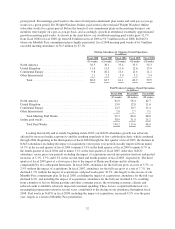

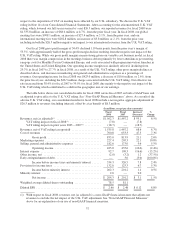

Please find page 55 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of sales in the prior year. The margin expansion was derived primarily from higher meeting fees per attendee, a

result of Monthly Pass in NACO, a price increase in the United Kingdom and price increases in a few

Continental European markets, and from growth in the licensing business.

Marketing expenses for fiscal 2007 increased $46.4 million, or 29.2%, to $205.3 million from $158.9

million for fiscal 2006. A significant portion of the increase resulted from additional television advertising. In the

United States, WeightWatchers.com began advertising on television for the first time in fiscal 2007, with its

national television advertising campaigns. For NACO, Continental Europe and the United Kingdom, we

increased our level of television advertising and experienced higher production costs as a result. We also invested

more heavily in other non-TV media and direct mail for the NACO business and online advertising in the

WeightWatchers.com business as compared to the prior year. As a percentage of net revenues, marketing

expenses were 14.0% for fiscal 2007, as compared to 12.9% in the prior year.

Selling, general and administrative expenses were $173.0 million for fiscal 2007 as compared to $137.3

million for fiscal 2006, an increase of $35.7 million. As a percentage of net revenues, selling, general and

administrative expenses were slightly above the prior year level, at 11.8% for fiscal 2007, as compared to 11.1%

in the same period last year. In fiscal 2007, selling, general and administrative expense has been impacted by our

ongoing technology investment in upgrading our systems, both office and meeting room, by employment-related

expenses, in particular to build our Continental Europe and marketing infrastructures, and to a lesser extent by

costs associated with our franchise acquisitions.

Operating income was $435.6 million for fiscal 2007, an increase of $55.6 million, or 14.6%, from $380.0

million for fiscal 2006. The operating income margin for fiscal 2007 was 29.7%, a decrease of 110 basis points

from 30.8% for the prior year, primarily as a result of our higher marketing expense.

Interest expense increased $59.8 million to $109.3 million for fiscal 2007, as compared to $49.5 million for

fiscal 2006, while the average effective interest rate declined slightly. The increase in interest expense was

primarily the result of higher debt outstanding. We raised our debt level in the first quarter of fiscal 2007 to

finance the repurchase of 19.1 million of our shares (as further explained in “Liquidity and Capital Resources—

Stock Transactions”).

In connection with the refinancing of the WW.com Credit Facilities and the WWI Credit Facility (as further

explained in “Item 6. Selected Financial Data—Items Affecting Comparability—Debt Refinancing”) we

recorded a charge of $3.0 million in the first quarter of fiscal 2007 relating to the write-off of the deferred

financing costs associated with this WeightWatchers.com debt and of $1.3 million in the second quarter of fiscal

2006 for early extinguishment of debt relating to WWI. These charges represented the write-off of a portion of

deferred financing costs associated with this old debt.

Our effective tax rate for fiscal 2007 was 38.4%, as compared to 36.5% for fiscal 2006. In fiscal 2006, we

recognized a tax benefit of $6.3 million by reversing tax reserves which, due to the resolution of certain tax

matters were no longer necessary, partially offset by adjustments to our tax valuation allowance for foreign tax

net operating loss carryforwards.

42