WeightWatchers 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

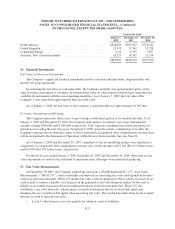

• Level 2—Observable inputs other than Level 1 prices, such as quoted prices for similar assets or

liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be

corroborated by observable market data for substantially the full term of the assets or liabilities.

• Level 3—Unobservable inputs that are supported by little or no market activity and that are significant

to the fair value of the assets or liabilities.

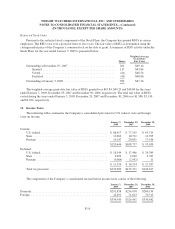

Derivative Financial Instruments

The fair values for the Company’s derivative financial instruments are determined using observable current

market information such as the prevailing LIBOR interest rate and LIBOR yield curve rates and include

consideration of counterparty risk. See Note 16 for disclosures related to derivative financial instruments. The

following table presents the aggregate fair value of the Company’s derivative financial instruments at January 3,

2009:

Fair Value Measurements Using:

Total

Fair

Value

Quoted Prices in

Active Markets

for Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Interest rate swap liability .................... $61,532 — $61,532 —

On February 12, 2008, the FASB issued Staff Position No. FAS 157-2, “Effective Date of FASB Statement

No. 157,” which delays the effective date of SFAS 157 to fiscal 2009 for all non-financial assets and

non-financial liabilities, except those that are recognized or disclosed at fair value in the financial statements on

at least an annual basis. The Company adopted this Staff Position beginning December 30, 2007 and deferred the

application of SFAS 157 to goodwill and other intangible assets until the beginning of fiscal 2009.

On December 30, 2007, the Company adopted the provisions of FASB Statement No. 159, “The Fair Value

Option for Financial Assets and Liabilities—Including an amendment of FASB Statement No. 115” (“SFAS

159”). SFAS 159 permits companies to make an irrevocable election to measure certain financial assets and

liabilities at fair value. Unrealized gains and losses on items for which the fair value option has been elected are

required to be recorded in earnings at each subsequent reporting date. Upon adopting SFAS 159, the Company

did not elect the fair value option under this standard for any of its financial assets or liabilities.

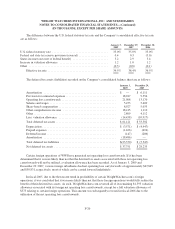

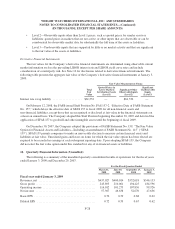

18. Quarterly Financial Information (Unaudited)

The following is a summary of the unaudited quarterly consolidated results of operations for the fiscal years

ended January 3, 2009 and December 29, 2007.

For the Fiscal Quarters Ended

March 31,

2008

June 30,

2008

September 27,

2008

January 3,

2009

Fiscal year ended January 3, 2009

Revenues, net ....................................... $437,027 $400,014 $352,618 $346,153

Gross profit ......................................... 245,895 210,061 194,425 184,596

Operating income .................................... 116,012 101,273 107,836 99,926

Net income ......................................... 57,367 46,638 52,670 47,656

Basic EPS .......................................... 0.72 0.59 0.68 0.62

Diluted EPS ........................................ 0.72 0.59 0.67 0.62

F-28