WeightWatchers 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

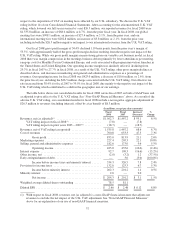

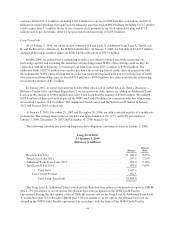

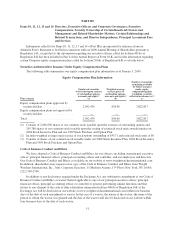

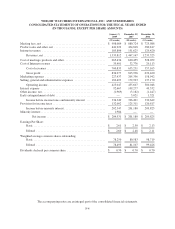

The following table summarizes our future contractual obligations as of January 3, 2009:

Payment Due by Period

Total

Less than

1 Year

1-3

Years

3-5

Years

More than

5 Years

(in millions)

Long-Term Debt(1)

Principal ...................................... $1,647.5 $162.5 $730.0 $290.0 $465.0

Interest ....................................... 279.1 92.5 119.8 64.9 1.9

Operating Leases ................................... 99.5 29.0 38.4 16.0 16.1

Other long-term obligations(2) ......................... 4.4 0.2 1.0 1.2 2.0

Total ......................................... $2,030.5 $284.2 $889.2 $372.1 $485.0

(1) Due to the fact that all of our debt is variable rate based, we have assumed for purposes of this table that the

interest rate on all of our debt as of January 3, 2009 remains constant for all periods presented.

(2) Other long-term obligations primarily consist of deferred rent costs. The provision for income tax

contingencies recorded in accordance with FIN 48 and included in other long-term liabilities on the

consolidated balance sheet is not included in the table above due to the fact that the Company is unable to

estimate the timing of payment for this liability.

Debt obligations due to be repaid in the next 12 months are expected to be satisfied with operating cash

flows. We believe that cash flows from operating activities, together with borrowings available under our

Revolver, will be sufficient for the next 12 months to fund currently anticipated capital expenditure requirements,

debt service requirements and working capital requirements.

Franchise Acquisitions

In June 2008, we acquired substantially all of the assets of two of our franchisees, Weight Watchers of

Syracuse, Inc. and Dieters of the Southern Tier, Inc., for a combined purchase price of approximately $20.9

million.

In June 2008, we acquired substantially all of the assets of our Wichita, Kansas franchisee for a purchase

price of approximately $5.7 million.

In January 2008, we acquired substantially all of the assets of our Palm Beach, Florida franchisee for a

purchase price of approximately $12.9 million.

In June 2007, we acquired substantially all of the assets of our British Columbia franchisee for a purchase

price of $15.8 million that was financed through cash from operations.

China Joint Venture

In February 2008, we entered into a joint venture with Groupe DANONE S.A. to establish a weight

management business in the People’s Republic of China. The joint venture, 51% owned by us and 49% owned by

Groupe DANONE, commenced retail operations in China in September 2008.

Stock Transactions

On October 9, 2003, our Board of Directors authorized a program to repurchase up to $250.0 million of our

outstanding common stock. On each of June 13, 2005 and May 25, 2006, our Board of Directors authorized

adding $250.0 million to this program. Under this program, we will not purchase shares held by Artal. This

program currently has no expiration date. As of fiscal year-end 2008, $100.5 million remains available to

purchase our shares under this program. From fiscal 2003 through fiscal 2008, we purchased 15.6 million shares

of common stock in the open market for a total purchase price of $649.5 million.

46