WeightWatchers 2008 Annual Report Download - page 77

Download and view the complete annual report

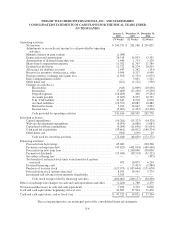

Please find page 77 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

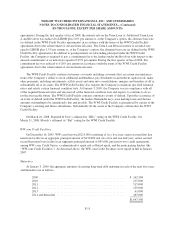

On December 11, 2006, the Company acquired substantially all of the assets of its western Michigan

franchisee, Weight Watchers of Western Michigan, Inc., for a net purchase price of $37,262 plus assumed

liabilities and transaction costs of $2,284, and reacquired its franchise rights in Greece and Italy for an aggregate

purchase price of $4,297. The total purchase price for these two acquisitions has been allocated to franchise

rights acquired ($42,612), fixed assets ($784), inventory ($445) and other current assets ($2).

On June 3, 2007, the Company acquired substantially all of the assets of its British Columbia franchisee,

Weight Watchers of British Columbia Inc., for a net purchase price of $15,282, plus assumed liabilities and

transaction costs of $532. The total purchase price has been allocated to franchise rights acquired ($15,718),

inventory ($88), fixed assets ($7) and other current assets ($1).

On January 31, 2008, the Company acquired substantially all of the assets of its Palm Beach, Florida

franchisee, Weight Watchers of Palm Beach County, Inc., for a net purchase price of $12,936, plus assumed

liabilities and transaction costs of $319. The total purchase price has been allocated to franchise rights acquired

($12,693), inventory ($113), fixed assets ($299) and other current assets ($150).

On June 13, 2008, the Company acquired substantially all of the assets of its Wichita, Kansas franchisee,

Weight Watchers of Greater Wichita, Inc., for a net purchase price of $5,734. The total purchase price has been

allocated to franchise rights acquired ($5,676) and prepaid expenses ($58).

On June 19, 2008, the Company acquired substantially all of the assets of two of its franchisees, Weight

Watchers of Syracuse, Inc. and Dieters of the Southern Tier, Inc., for a combined net purchase price of $20,935,

plus assumed liabilities and transaction costs of $164. The total purchase price has been allocated to franchise

rights acquired ($20,948), fixed assets ($36), inventory ($56) and prepaid expenses ($59).

The effects of these franchise acquisitions, individually or in the aggregate, were not material to the

Company’s consolidated financial position, results of operations, or operating cash flows in any of the periods

presented.

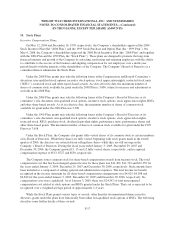

4. Joint Venture

On February 5, 2008, Weight Watchers Asia Holdings Ltd. (“Weight Watchers Asia”), a direct wholly-

owned subsidiary of the Company, and Danone Dairy Asia, an indirect wholly-owned subsidiary of Groupe

DANONE S.A., entered into a joint venture agreement to establish a weight management business in the

People’s Republic of China. Pursuant to the terms of the joint venture agreement, Weight Watchers Asia and

Danone Dairy Asia own 51% and 49%, respectively, of the Joint Venture.

Because the Company has a direct controlling financial interest in the Joint Venture, it began to consolidate

this entity in the first quarter of fiscal 2008 under the provisions of Accounting Research Bulletin No. 51,

“Consolidated Financial Statements.”

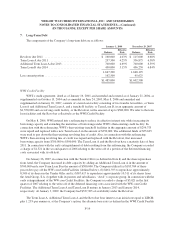

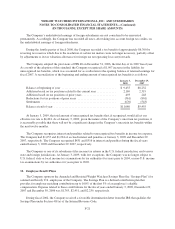

5. Goodwill and Other Intangible Assets

The Company performed its annual impairment review of goodwill and other indefinite-lived intangible

assets as of January 3, 2009 and December 29, 2007 and determined that no impairment existed. Goodwill is due

mainly to the acquisition of the Company by H.J. Heinz Company (“Heinz”) in 1978 and the acquisition of

WW.com in 2005. For the year ended January 3, 2009, the change in goodwill is due to foreign currency

fluctuations. Franchise rights acquired are due to acquisitions of the Company’s franchised territories. For the

year ended January 3, 2009, franchise rights acquired increased due to the franchise acquisitions described in

Note 3, as well as foreign currency fluctuations.

F-12