WeightWatchers 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

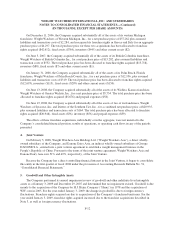

Stock Option Awards

Pursuant to the option components of the Stock Plans, the Company’s Board of Directors authorized the

Company to enter into agreements under which certain employees received stock options. The options are

exercisable based on the terms outlined in the agreements. The options vest over a period of three to five years

and the expiration terms range from five to ten years. Options outstanding at January 3, 2009 have an exercise

price between $2.13 and $56.21 per share.

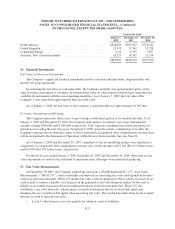

The fair value of each option award is estimated on the date of grant using the Black-Scholes option pricing

model with the weighted average assumptions noted in the following table. Expected volatility is based on the

historical volatility of the Company’s stock with certain time periods excluded due to historical events which are

not expected to recur. Since the Company’s option exercise history is limited, it has estimated the expected term

of option grants to be the midpoint between the vesting period and the contractual term of each award, as is

permitted under Staff Accounting Bulletin No. 107 and Staff Accounting Bulletin No. 110, both entitled “Share-

Based Payment.” The risk free interest rate is based on the U.S. Treasury yield curve in effect on the date of grant

which most closely corresponds to the expected term of the option. The dividend yield is based on our historic

average dividend yield.

January 3,

2009

December 29,

2007

December 30,

2006

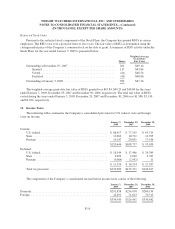

Dividend yield .......................................... 1.5% 1.5% 1.4%

Volatility .............................................. 26.8% 26.5% 27.1%

Risk-free interest rate .................................... 2.0% – 3.9% 3.5% – 4.9% 4.3% – 5.2%

Expected term (years) .................................... 6.5 7.0 7.4

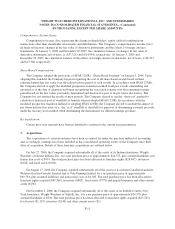

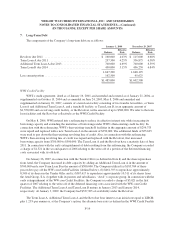

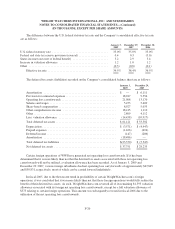

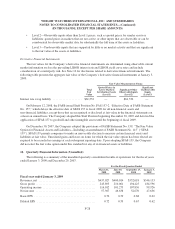

A summary of option activity under the Stock Plans for the year ended January 3, 2009 is presented below:

Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life (Yrs.)

Aggregate

Intrinsic

Value

Outstanding at December 29, 2007 ............................ 2,225 $42.69

Granted ............................................. 641 $43.76

Exercised ............................................ (255) $31.63

Canceled ............................................ (344) $46.14

Outstanding at January 3, 2009 ............................... 2,267 $43.71 6.7 $1,821

Exercisable at January 3, 2009 ............................... 940 $40.83 4.2 $1,821

The weighted-average grant-date fair value of options granted was $12.08, $15.41 and $15.40 for the years

ended January 3, 2009, December 29, 2007 and December 30, 2006, respectively. The total intrinsic value of

options exercised was $3,026, $28,876 and $17,864 for the years ended January 3, 2009, December 29, 2007 and

December 30, 2006, respectively.

Cash received from options exercised during the years ended January 3, 2009, December 29, 2007 and

December 30, 2006 was $8,075, $18,563 and $5,779, respectively. The tax benefits realized from options

exercised and RSUs vested totaled $1,504, $11,919 and $7,777 for the years ended January 3, 2009,

December 29, 2007 and December 30, 2006, respectively.

F-18