WeightWatchers 2008 Annual Report Download - page 46

Download and view the complete annual report

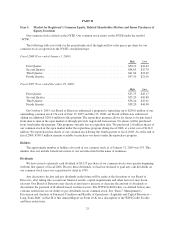

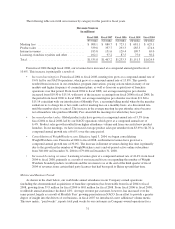

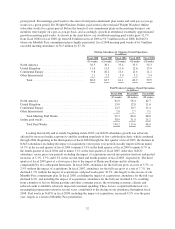

Please find page 46 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the United Kingdom, after four years of attendance increases, attendance declined 3.1% in fiscal 2005

and 7.4% in fiscal 2006. The declining trend began as a result of a negative member and leader reaction to a new

program innovation launched in January 2005. We worked to simplify the program, improve the meeting

experience, and strengthen the quality of our field management and leader force. As a result, over the course of

fiscal 2006, the negative U.K. attendance trend reversed from a negative 17.2% year-over-year decline in the first

quarter, to 7.0% year-over-year growth in the fourth quarter. This trend continued into the first quarter of 2007

with a growth rate of 9.8% versus the prior year period, but the growth slowed to 2.2% in the second quarter

versus the prior year period and turned negative in the second half of fiscal 2007, posting declines of 4.2% and

2.4% in the third and fourth quarters of fiscal 2007, respectively, versus the prior year periods. Paid weeks rose

9.7%, from 11.6 million in fiscal 2006 to 12.8 million in fiscal 2007. In fiscal 2008, attendance in the United

Kingdom declined 2.4% versus the prior year. The U.K. market has responded positively to its new program that

was soft-launched in December 2008, but like the U.S. market, the U.K. market has experienced a worsening

economy which has negatively impacted attendance. In fiscal 2008, paid weeks grew 17.4% versus the prior

year, due largely to the introduction of Monthly Pass in the third quarter of fiscal 2007.

Continental Europe saw attendance growth in every fiscal year from 2000 through 2005. Continental

Europe’s attendance increased 1.1 million in fiscal 2004 primarily as a result of a program innovation in the third

quarter which helped drive increased attendance into fiscal 2005 and the first quarter of 2006; however, on a full

year basis in fiscal 2006, attendances in Continental Europe declined by 4.4% versus the prior year. Attendance

began to decline in the second quarter of fiscal 2006, by 7.2% in the second quarter, 7.8% in the third quarter and

10.6% in the fourth quarter, in each case versus the prior year period. We believe that the growth of the business

in Continental Europe prior to fiscal 2006 outpaced the expertise of the local management, and we have been

strengthening these teams. The declining attendance trend continued into fiscal 2007 (declines of 6.6% in the first

quarter, 7.5% in the second quarter, 11.7% in the third quarter and 9.4% in the fourth quarter, in each case versus

the prior year period) and ended the year with attendance 8.5% below the prior year level. Paid weeks in

Continental Europe declined 6.2%, from 11.4 million in fiscal 2006 to 10.7 million in fiscal 2007. We believe

that most of this weakness was the result of ineffective marketing and the resultant lack of new enrollments. In

fiscal 2008, Continental Europe experienced a 4.1% decline in attendance versus the prior year. However, the

introduction of Monthly Pass in Germany in the third quarter of fiscal 2007 and in France in April 2008 helped

drive an overall 16.5% increase in paid weeks for fiscal 2008 in Continental Europe versus the prior year.

The continued success of our WeightWatchers.com segment resulted in an increase in the number of online

paid weeks of 54.4%, from 25.2 million in fiscal 2006 to 38.9 million in fiscal 2008. This success is due largely

to the acquisition of new Weight Watchers Online subscribers in the United States as well as the launch of

WeightWatchers.com subscription products in new markets.

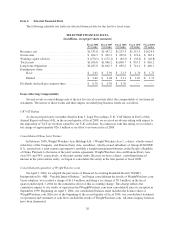

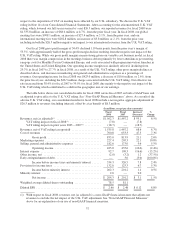

The Company has maintained an annual gross margin of 50% or more since fiscal 2001. Our staff is usually

paid on a commission basis and space is typically rented as needed. Moreover, we adjust the number of meetings

according to demand, including seasonal fluctuations. This variable cost structure has enabled us to maintain

these high margins even as we have expanded the number of our meetings over this period. When our attendance

growth outpaces our meeting growth, our gross margins typically improve. As our WeightWatchers.com business

continues to grow, we expect margins to continue to expand in this highly scalable business.

The Company has consistently generated operating income margins of 30% or more from fiscal 2001 to fiscal

2007, even while making significant investments in strengthening our management teams, particularly in North

America and Continental Europe, putting in place a stronger global marketing infrastructure, increasing our

investments in marketing and information technology and expensing share-based compensation beginning in fiscal

2006. In fiscal 2008, the operating income margin of the Company dipped below 30%, to 28%, due largely to the

adverse U.K. VAT ruling received in the second quarter of fiscal 2008 and the start-up costs of our China Joint

Venture.

33