WeightWatchers 2008 Annual Report Download - page 76

Download and view the complete annual report

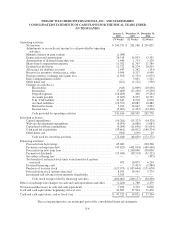

Please find page 76 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

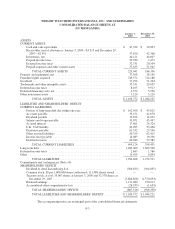

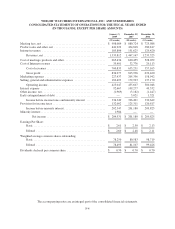

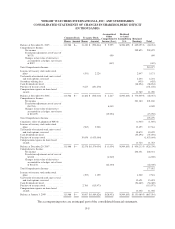

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

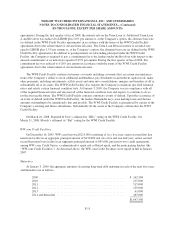

Comprehensive Income (Loss):

Comprehensive income (loss) represents the change in shareholders’ equity (deficit) resulting from

transactions other than shareholder investments and distributions. The Company’s comprehensive income (loss)

includes net income, changes in the fair value of derivative instruments and the effects of foreign currency

translations. At January 3, 2009 and December 29, 2007, the cumulative balance of changes in fair value of

derivative instruments, net of taxes, is ($37,326) and ($14,994), respectively. At January 3, 2009 and

December 29, 2007, the cumulative balance of the effects of foreign currency translations, net of taxes, is $8,393

and $13,340, respectively.

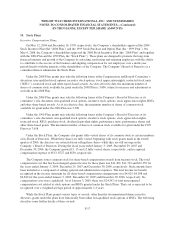

Share-Based Compensation:

The Company adopted the provisions of SFAS 123(R), “Share-Based Payment” on January 1, 2006. Upon

adopting this standard, the Company began recognizing the cost of all share-based awards based on their

estimated grant-date fair value over the related service period of such awards. In accordance with SFAS 123(R),

the Company elected to apply the modified prospective transition method to all past awards outstanding and

unvested as of the date of adoption and began recognizing the associated expense over the remaining vesting

period based on the fair values previously determined and disclosed as part of its pro forma disclosures. The

Company has not restated the results of prior periods. The Company elected to use the “short-cut” method to

calculate its historical pool of windfall tax benefits when it adopted SFAS 123(R). In accordance with the

modified prospective transition method of adopting SFAS 123(R), the Company elected to include the impact of

pro forma deferred tax assets (i.e., the “as if” windfall or shortfall) for purposes of determining assumed proceeds

under the treasury stock method when determining the denominator for diluted earnings per share.

Reclassification:

Certain prior year amounts have been reclassified to conform to the current year presentation.

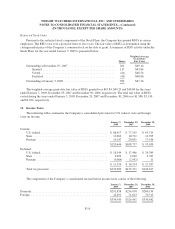

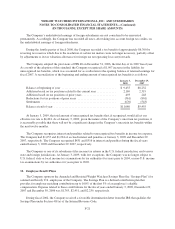

3. Acquisitions

The acquisitions of certain franchisees have been accounted for under the purchase method of accounting

and, accordingly, earnings have been included in the consolidated operating results of the Company since their

dates of acquisition. Details of these franchise acquisitions are outlined below.

On July 27, 2006, the Company acquired substantially all of the assets of its Indiana franchisee, Weight

Watchers of Greater Indiana, Inc., for a net purchase price of approximately $24,575, plus assumed liabilities and

transaction costs of $474. The total purchase price has been allocated to franchise rights ($24,847), inventory

($102) and fixed assets ($100).

On August 17, 2006, the Company acquired substantially all of the assets of its eastern Canadian franchisee,

Walmar (Eastern Canada) Limited and of Vale Printing Limited for a net purchase price of approximately

$49,781, plus assumed liabilities and transaction costs of $1,385. The total purchase price has been allocated to

franchise rights acquired ($49,366), inventory ($885), fixed assets ($779) and prepaid expenses and other current

assets ($136).

On November 2, 2006, the Company acquired substantially all of the assets of its Suffolk County, New

York franchisee, Weight Watchers of Suffolk, Inc., for a net purchase price of approximately $24,170, plus

assumed liabilities of $330. The total purchase price has been allocated to franchise rights acquired ($23,225),

fixed assets ($1,133), inventory ($140) and other current assets ($2).

F-11