WeightWatchers 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

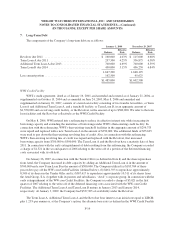

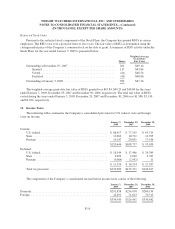

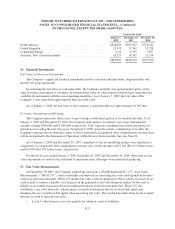

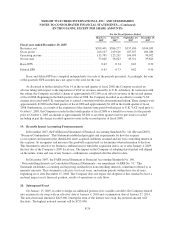

The difference between the U.S. federal statutory tax rate and the Company’s consolidated effective tax rate

are as follows:

January 3,

2009

December 29,

2007

December 30,

2006

U.S. federal statutory rate ...................................... 35.0% 35.0% 35.0%

Federal and state tax reserve provision (reversal) .................... 0.4 0.3 (3.0)

States income taxes (net of federal benefit) ........................ 3.2 2.9 3.4

Increase in valuation allowance ................................. 1.2 1.0 1.2

Other ...................................................... (0.3) (0.8) (0.1)

Effective tax rate ......................................... 39.5% 38.4% 36.5%

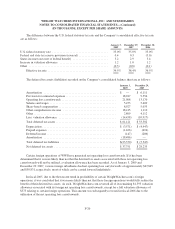

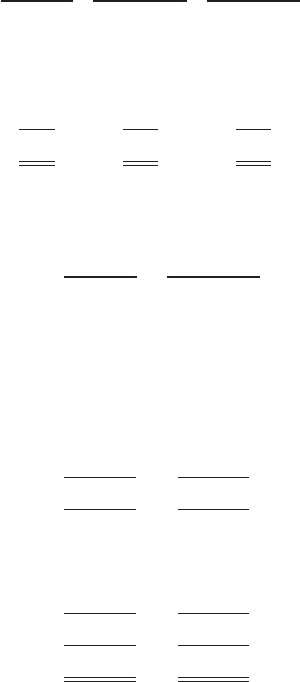

The deferred tax assets (liabilities) recorded on the Company’s consolidated balance sheet are as follows:

January 3,

2009

December 29,

2007

Amortization ................................................. $ — $ 6,111

Provision for estimated expenses .................................. 18,947 9,554

Operating loss carryforwards ..................................... 21,008 13,170

Salaries and wages ............................................. 5,473 5,409

Share-based compensation ....................................... 8,927 5,033

Other comprehensive income .................................... 18,415 1,110

Other ........................................................ 2,809 4,112

Less: valuation allowance ....................................... (14,458) (10,917)

Total deferred tax assets ......................................... $61,121 $ 33,582

Depreciation .................................................. $ (3,571) $ (4,447)

Prepaid expenses .............................................. (1,166) (694)

Deferred income ............................................... (147) (206)

Amortization ................................................. (18,486) —

Total deferred tax liabilities ...................................... $(23,370) $ (5,347)

Net deferred tax assets .......................................... $37,751 $ 28,235

Certain foreign operations of WWI have generated net operating loss carryforwards. If it has been

determined that it is more likely than not that the deferred tax assets associated with these net operating loss

carryforwards will not be utilized, a valuation allowance has been recorded. As of January 3, 2009 and

December 29, 2007, various foreign subsidiaries had net operating loss carryforwards of approximately $67,865

and $50,831, respectively, most of which can be carried forward indefinitely.

In fiscal 2005, due to the then recent trend in profitability of certain WeightWatchers.com’s foreign

operations, it was concluded that it was more likely than not that these foreign operations would fully realize the

benefit of their deferred tax assets. As such, WeightWatchers.com reversed all of its remaining $1,593 valuation

allowance associated with its foreign net operating loss carryforwards, except for a full valuation allowance of

$575 relating to certain foreign operations. This amount was subsequently reversed in fiscal 2006 due to the

utilization of the net operating loss carryforwards.

F-20