WeightWatchers 2008 Annual Report Download - page 75

Download and view the complete annual report

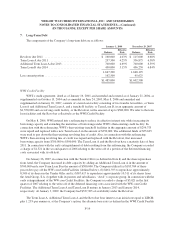

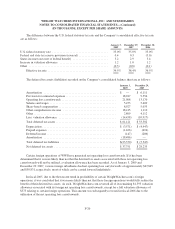

Please find page 75 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

likely of being realized upon ultimate settlement. As a result of the December 31, 2006 adoption of FIN 48, the

Company increased its tax liability for unrecognized tax benefits by $1,907, which was accounted for as a

reduction to the opening balance of retained earnings for fiscal 2007.

In addition, under SFAS No. 109 assets and liabilities acquired in purchase business combinations are

assigned their fair values and deferred taxes are provided for lower or higher tax bases.

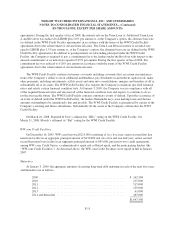

Derivative Instruments and Hedging:

The Company enters into interest rate swaps to hedge a substantial portion of its variable rate debt. In

accordance with the provisions of SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” and its related amendments, SFAS No. 138, “Accounting for Certain Derivative Instruments and

Certain Hedging Activities” and SFAS No. 149, “Amendment of Statement on Derivative Instruments and

Hedging Activities,” all derivative financial instruments are recorded on the consolidated balance sheets at their

fair value as either assets or liabilities. Changes in the fair value of derivatives are recorded each period in

earnings or comprehensive income (loss), depending on whether a derivative is designated as effective as part of

a hedge transaction and, if it is, the type of hedge transaction. Gains and losses on derivative instruments reported

in accumulated other comprehensive income (loss) are included in earnings in the periods in which earnings are

affected by the hedged item.

In March 2008, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities—an

amendment of FASB Statement No. 133.” This statement amends and expands the disclosure requirements

related to derivative instruments and hedging activities by requiring qualitative disclosures about objectives and

strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on

derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. The

Company is required to adopt the provisions of this statement at the beginning of fiscal 2009, at which time it

will amend its disclosures accordingly.

Investments:

The Company uses the cost method to account for investments in which it holds 20% or less of the

investee’s voting stock and over which it does not have significant influence.

Deferred Financing Costs:

Deferred financing costs consist of fees paid by the Company as part of the establishment, exchange and/or

modification of the Company’s long-term debt. During the fiscal years ended December 29, 2007 and

December 30, 2006, the Company incurred deferred financing costs of $5,417 and $1,980, respectively,

associated with the establishment of the WW.com Credit Facilities (as defined in Note 7) and the refinancing of

WWI’s Credit Facility (as defined in Note 7). Such costs are being amortized using the straight-line method over

the term of the related debt. Amortization expense for the fiscal years ended January 3, 2009, December 29, 2007

and December 30, 2006 was $1,440, $1,713, and $1,529, respectively. In connection with the paydown of the

WW.com Credit Facilities and the refinancing of WWI’s Credit Facility, the Company wrote off deferred

financing costs of $3,021, and $1,321 in the fiscal years ended December 29, 2007 and December 30, 2006,

respectively. These amounts have been recorded as components of early extinguishment of debt. See Note 7 for

details of the early extinguishment and refinancing.

F-10