WeightWatchers 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

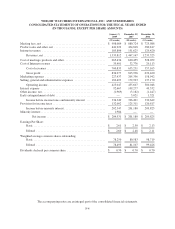

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

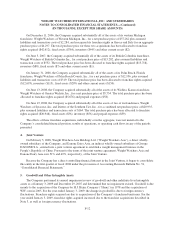

7. Long-Term Debt

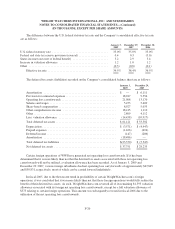

The components of the Company’s long-term debt are as follows:

January 3, 2009 December 29, 2007

Balance

Effective

Rate Balance

Effective

Rate

Revolver due 2011 ..................................... $ 160,000 4.03% $ 115,000 6.68%

Term Loan A due 2011 .................................. 297,500 4.25% 336,875 6.58%

Additional Term Loan A due 2013 ......................... 700,000 4.69% 700,000 6.59%

Term Loan B due 2014 .................................. 490,000 5.15% 496,250 6.84%

1,647,500 1,648,125

Less current portion ..................................... 162,500 45,625

$1,485,000 $1,602,500

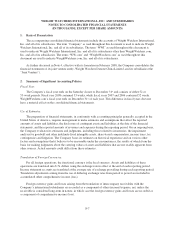

WWI Credit Facility

WWI’s credit agreement, dated as of January 16, 2001, and amended and restated as of January 21, 2004, as

supplemented on October 19, 2004 and as amended on June 24, 2005, May 8, 2006 and amended and

supplemented on January 26, 2007, consists of a term loan facility consisting of two tranche A facilities, or Term

Loan A and Additional Term Loan A, and a tranche B facility, or Term Loan B, in an aggregate amount of

$1,550,000 and a revolving credit facility, or the Revolver, in the amount of up to $500,000. We refer to the term

loan facilities and the Revolver collectively as the WWI Credit Facility.

On May 8, 2006, WWI entered into a refinancing to reduce its effective interest rate while increasing its

borrowing capacity and extending the maturities of borrowings under WWI’s then-existing credit facility. In

connection with the refinancing, WWI’s then-existing tranche B facilities in the aggregate amount of $294,375

were repaid and replaced with a new Term Loan A in the amount of $350,000. The additional funds of $55,625

were used to pay down the then-existing revolving line of credit. Also, in connection with this refinancing,

WWI’s then-existing revolving line of credit was repaid and replaced with the Revolver, that increased

borrowing capacity from $350,000 to $500,000. The Term Loan A and the Revolver have a maturity date of June

2011. In connection with the early extinguishment of debt resulting from this refinancing, the Company recorded

a charge of $1,321 in the second quarter of 2006 relating to the write-off of a portion of the deferred financing

costs associated with its old debt.

On January 26, 2007, in connection with the Tender Offer (as defined in Note 8) and the share repurchase

from Artal, the Company increased its debt capacity by adding an Additional Term Loan A in the amount of

$700,000 and a new Term Loan B in the amount of $500,000. The Company utilized (a) $185,784 of these

proceeds to pay off the WW.com Credit Facilities (defined below), (b) $461,593 to repurchase approximately

8,548 of its shares in the Tender Offer and (c) $567,617 to repurchase approximately 10,511 of its shares from

the Artal Group, S.A. (together with its parents and subsidiaries, “Artal”) corporate group. In connection with the

early extinguishment of the WW.com Credit Facilities, the Company recorded a charge of $3,021 in the first

quarter of 2007 relating to the write-off of the deferred financing costs associated with the WW.com Credit

Facilities. The Additional Term Loan A and Term Loan B mature in January 2013 and January 2014,

respectively. At January 3, 2009, the Company had $337,903 of availability under the Revolver.

The Term Loan A, Additional Term Loan A and the Revolver bear interest at an initial rate equal to LIBOR

plus 1.25% per annum or, at the Company’s option, the alternate base rate (as defined in the WWI Credit Facility

F-14